Go here to Read this Fast! Here’s why the Ethervista, Uniswap, and AAVE are rising

Originally appeared here:

Here’s why the Ethervista, Uniswap, and AAVE are rising

Go here to Read this Fast! Here’s why the Ethervista, Uniswap, and AAVE are rising

Originally appeared here:

Here’s why the Ethervista, Uniswap, and AAVE are rising

Go here to Read this Fast! Anchorage announces custody support for Bitcoin L2 Stacks

Originally appeared here:

Anchorage announces custody support for Bitcoin L2 Stacks

Go here to Read this Fast! CFTC: Uniswap allowed illegal digital asset derivatives trading

Originally appeared here:

CFTC: Uniswap allowed illegal digital asset derivatives trading

Go here to Read this Fast! Further downswings for ADA, XRP; New presale token defies bearish trends

Originally appeared here:

Further downswings for ADA, XRP; New presale token defies bearish trends

Go here to Read this Fast! 5 years later, Pi Network’s mainnet launch remains elusive

Originally appeared here:

5 years later, Pi Network’s mainnet launch remains elusive

Go here to Read this Fast! Injective launches tokenized index tracking BlackRock’s BUIDL fund

Originally appeared here:

Injective launches tokenized index tracking BlackRock’s BUIDL fund

Go here to Read this Fast! Red alert: Toncoin price flips key support as death cross nears

Originally appeared here:

Red alert: Toncoin price flips key support as death cross nears

Two major technology companies—Siemens and Samsung—have made significant strides in the crypto sector, each advancing their involvement in different ways. Siemens issues €300 million digital bond. German technology giant Siemens launched its second digital bond, valued at €300 million, on a public blockchain, according to a Sept. 4 statement. The bond, set to mature in […]

The post Siemens and Samsung ramp up Web3 moves with digital bonds and startup investments appeared first on CryptoSlate.

Originally appeared here:

Siemens and Samsung ramp up Web3 moves with digital bonds and startup investments

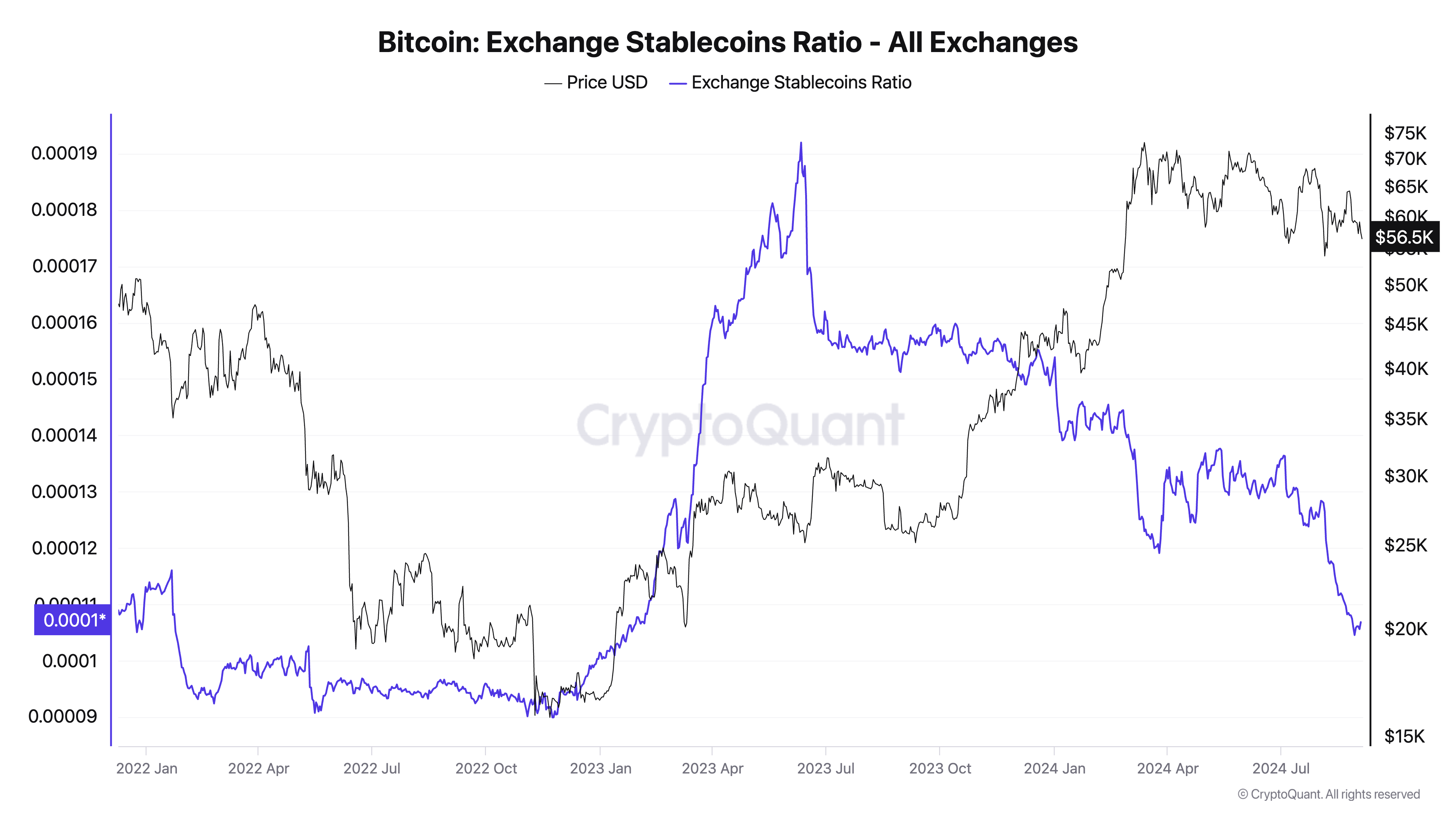

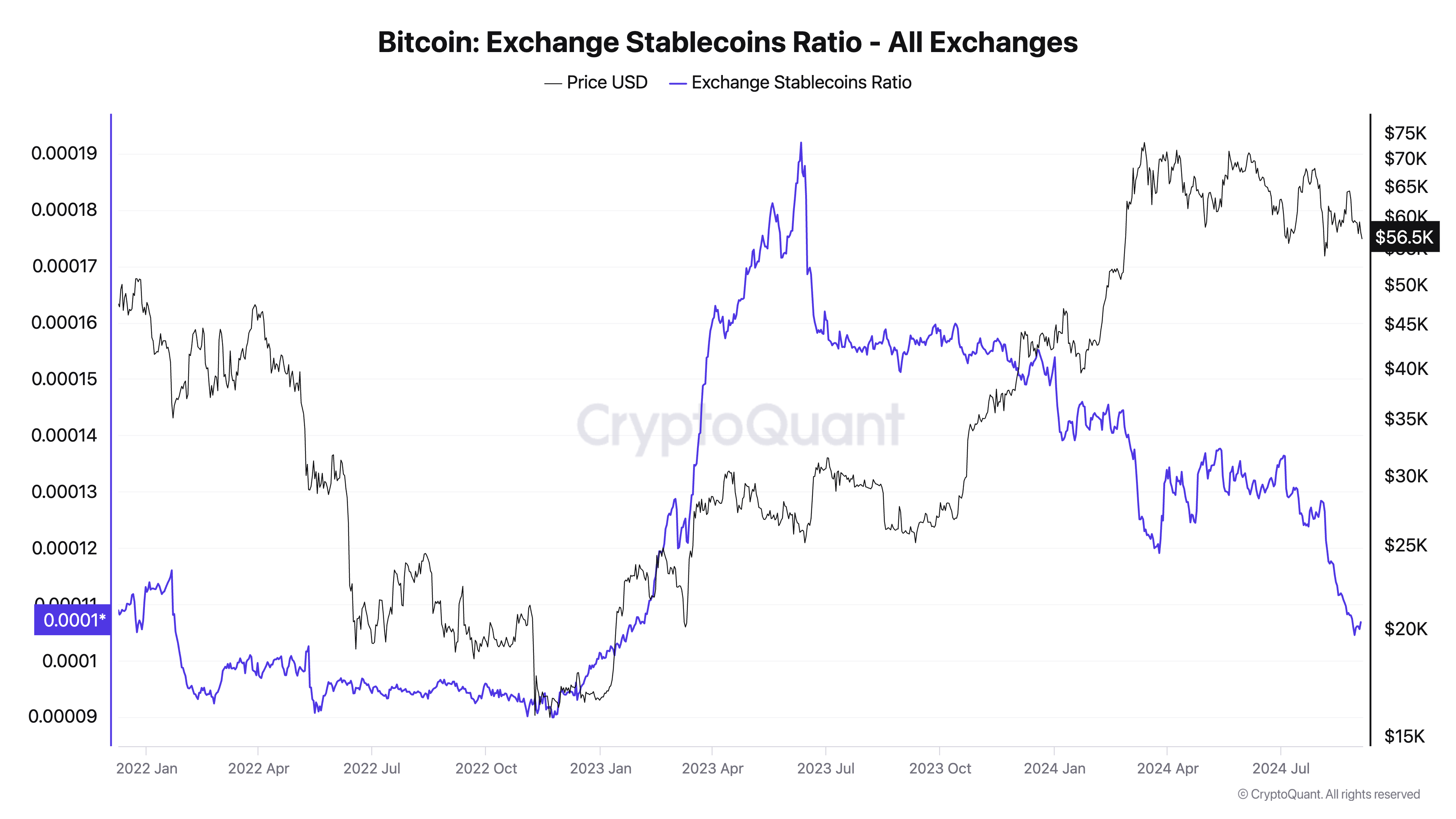

The exchange stablecoin ratio measures the balance between stablecoins held on exchanges and Bitcoin. When this ratio drops sharply, it usually signals a reduction in the amount of stablecoins available on exchanges compared to Bitcoin reserves. It often reflects growing demand for Bitcoin, as traders either convert stablecoins into BTC or withdraw them from exchanges […]

The post Low exchange stablecoin ratio hints at strong Bitcoin demand appeared first on CryptoSlate.

Go here to Read this Fast! Low exchange stablecoin ratio hints at strong Bitcoin demand

Originally appeared here:

Low exchange stablecoin ratio hints at strong Bitcoin demand