Go Here to Read this Fast! How to turn off subtitles in Max

Originally appeared here:

How to turn off subtitles in Max

Go Here to Read this Fast! How to turn off subtitles in Max

Originally appeared here:

How to turn off subtitles in Max

Guggenheim Treasury Securities (GTS), a subsidiary of financial consulting firm Guggenheim Capital, has issued $20 million worth of Digital Commercial Paper (DCP) on Ethereum. The DCP received a P-1 credit rating from Moody’s. According to a Sept. 26 statement, Guggenheim will issue the paper via a blockchain platform developed by Zeconomy called AmpFi.Digital, which offers […]

The post Guggenheim issues $20 million worth of tokenized commercial paper on Ethereum appeared first on CryptoSlate.

Originally appeared here:

Guggenheim issues $20 million worth of tokenized commercial paper on Ethereum

Geneva, Switzerland – September 26, 2024 – TRON DAO united with the global blockchain community as a Title Sponsor at TOKEN2049 Singapore, the world’s largest Web3 conference, held at the Marina Bay Sands. At the conference, Dave Uhryniak, Community Spokesperson at the TRON DAO, delivered an insightful keynote emphasizing TRON’s commitment to strengthening blockchain security. […]

The post TRON DAO Unites With Global Community at TOKEN2049 Singapore appeared first on CryptoSlate.

Go here to Read this Fast! TRON DAO Unites With Global Community at TOKEN2049 Singapore

Originally appeared here:

TRON DAO Unites With Global Community at TOKEN2049 Singapore

SHIB gained 12% in 24 hours and aimed to reclaim April’s low.

Strong spot demand and bullish sentiment boosted the rally.

Shiba Inu [SHIB] recorded a sharp upswing on the 26th of Septembe

The post Mapping Shiba Inu’s price prediction as SHIB rallies 12% in 24 hours appeared first on AMBCrypto.

Ethereum dominance is declining despite overall market cap being on the rise.

ETH staying above all weekly moving averages signals strength.

Ethereum [ETH], the second-largest cryptocurrency

The post Ethereum dominance dips – Is ETH poised for a rebound or decline? appeared first on AMBCrypto.

Go here to Read this Fast! Ethereum dominance dips – Is ETH poised for a rebound or decline?

Originally appeared here:

Ethereum dominance dips – Is ETH poised for a rebound or decline?

The appearance of an inverse head-and-shoulders pattern on APT’s chart positions it well for potential gains.

Initially, the market may see a period of accumulation, setting the stage for APT’s

The post Will Aptos rally above $10? Key levels to monitor appeared first on AMBCrypto.

Go here to Read this Fast! Will Aptos rally above $10? Key levels to monitor

Originally appeared here:

Will Aptos rally above $10? Key levels to monitor

Bitcoin’s expanding triangle pattern signals high volatility, setting the stage for a breakout or drop.

MVRV ratio suggests holders are in profit, but there’s room before critical profit-ta

The post Bitcoin’s expanding triangle, explained: Looming breakout or trap? appeared first on AMBCrypto.

Going over the main skills you need to be a “good” data scientist

Originally appeared here:

What 15 Data Scientists Say About Key Skills

Go Here to Read this Fast! What 15 Data Scientists Say About Key Skills

How data scientists can best communicate with non-DS people

Originally appeared here:

A Data Scientist’s Guide to Stakeholders

Go Here to Read this Fast! A Data Scientist’s Guide to Stakeholders

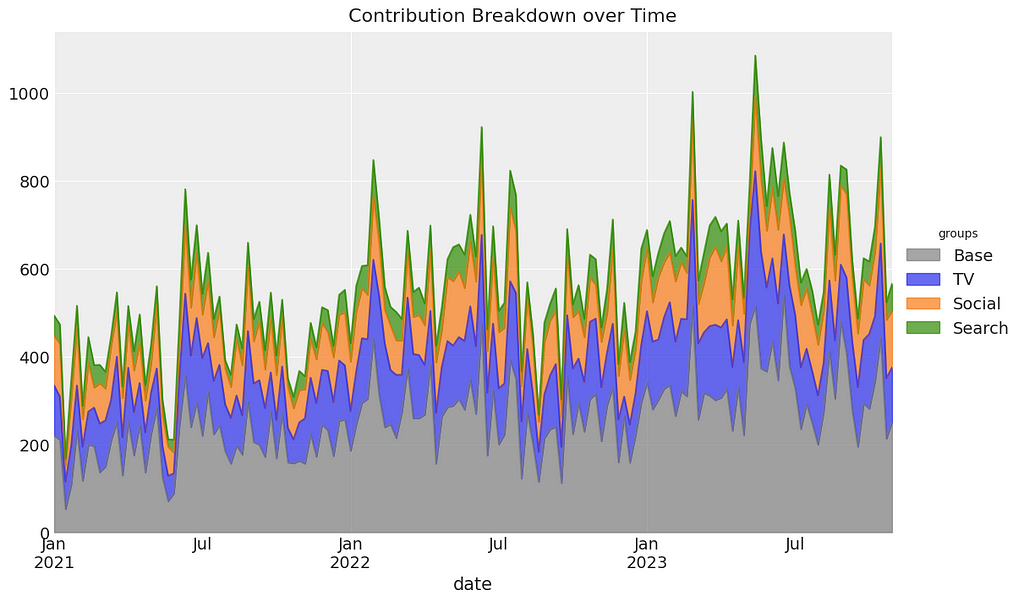

Welcome to part 1 of my series on marketing mix modeling (MMM), a hands-on guide to help you master MMM. Throughout this series, we’ll cover key topics such as model training, validation, calibration and budget optimisation, all using the powerful pymc-marketing python package. Whether you’re new to MMM or looking to sharpen your skills, this series will equip you with practical tools and insights to improve your marketing strategies.

In this article, we’ll start by providing some background on Bayesian MMM, including the following topics:

We will then move on to a walkthrough in Python using the pymc-marketing package, diving deep into the following areas:

The full notebook can be found here:

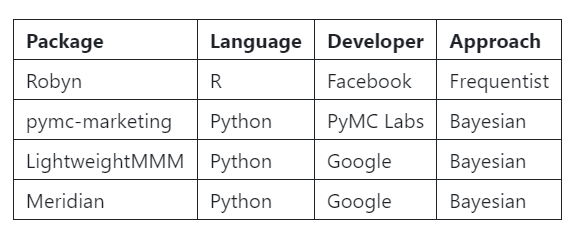

Let’s begin with a brief overview of Marketing Mix Modeling (MMM). We’ll explore various open-source packages available for implementation and delve into the principles of Bayesian MMM, including the concept of priors. Finally, we’ll evaluate the default priors used in pymc-marketing to gauge their suitability and effectiveness..

When it comes to MMM, there are several open-source packages we can use:

There are several compelling reasons to focus on pymc-marketing in this series:

You can check out the pymc-marketing package here, they offer some great notebook to illustrate some of the packages functionality:

How-to – pymc-marketing 0.9.0 documentation

You’ll notice that 3 out of 4 of the packages highlighted above take a Bayesian approach. So let’s take a bit of time to understand what Bayesian MMM looks like! For beginners, Bayesian analysis is a bit of a rabbit hole but we can break it down into 5 key points:

Bayesian priors are supplied as probability distributions. Instead of assigning a fixed value to a parameter, we provide a range of potential values, along with the likelihood of each value being the true one. Common distributions used for priors include:

You may hear the term informative priors. Ideally, we supply these based on expert knowledge or randomized experiments. Informative priors reflect strong beliefs about the parameter values. However, when this is not feasible, we can use non-informative priors, which spread probability across a wide range of values. Non-informative priors allow the data to dominate the posterior, preventing prior assumptions from overly influencing the outcome.

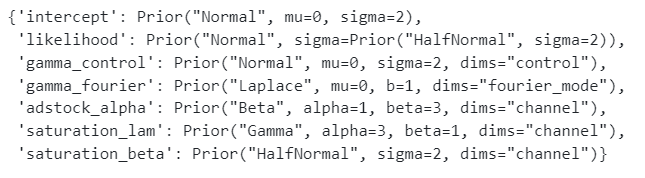

When using the pymc-marketing package, the default priors are designed to be weakly informative, meaning they provide broad guidance without being overly specific. Instead of being overly specific, they guide the model without restricting it too much. This balance ensures the priors guide the model without overshadowing the data..

To build reliable models, it’s crucial to understand the default priors rather than use them blindly. In the following sections, we will examine the various priors used in pymc-marketing and explain why the default choices are sensible for marketing mix models.

We can start by using the code below to inspect the default priors:

dummy_model = MMM(

date_column="",

channel_columns=[""],

adstock=GeometricAdstock(l_max=4),

saturation=LogisticSaturation(),

)

dummy_model.default_model_config

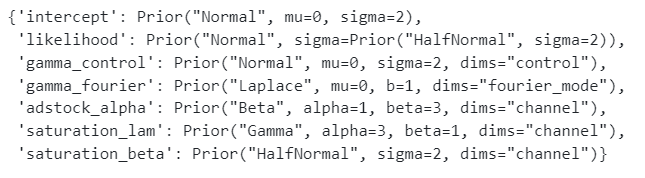

Above I have printed out a dictionary containing the 7 default priors — Let’s start by briefly understanding what each one is:

Next we are going to focus on gaining a more in depth understanding of parameters for marketing and control variables.

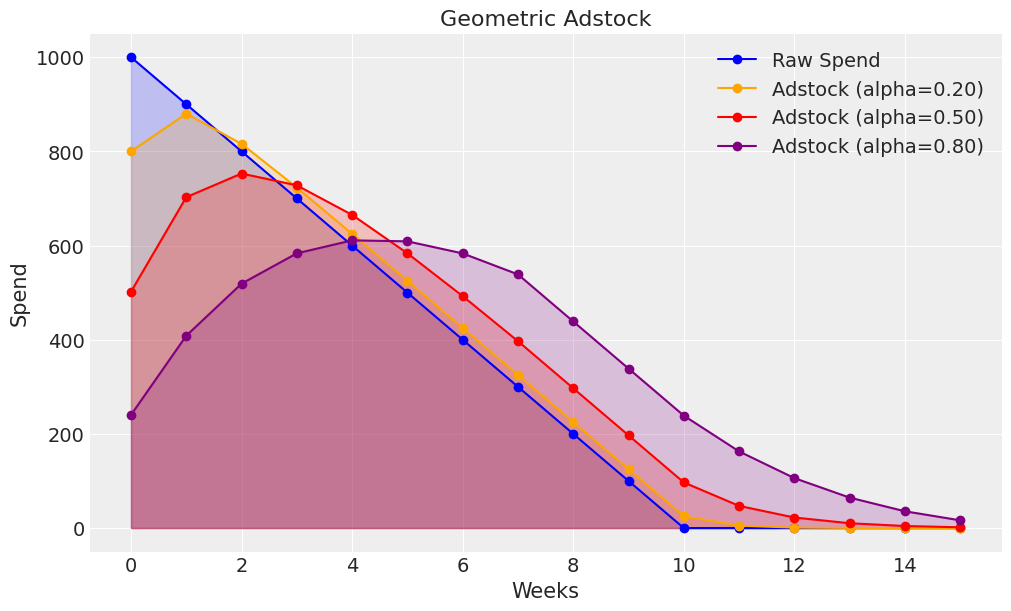

Adstock reflects the idea that the influence of a marketing activity is delayed and builds up over time. The adstock alpha (the decay rate) controls how quickly the effect diminishes over time, determining how long the impact of the marketing activity continues to influence sales.

A beta distribution is used as a prior for adstock alpha. Let’s first visualise the beta distribution:

alpha = 1

beta_param = 3

x1 = np.linspace(0, 1, 100)

y1 = beta.pdf(x1, alpha, beta_param)

plt.figure(figsize=(8, 5))

plt.plot(x1, y1, color='blue')

plt.fill_between(x1, y1, color='blue', alpha=0.3)

plt.title('Geometric Adstock: Beta distribution (alpha=1, beta=3)')

plt.xlabel('Adstock alpha')

plt.ylabel('Probability density')

plt.grid(True)

plt.show()

We typically constrain adstock alpha values between 0 and 1, making the beta distribution a sensible choice. Specifically, using a beta(1, 3) prior for adstock alpha reflects the belief that, in most cases, the decay rate should be relatively high, meaning the effect of marketing activities wears off quickly.

To build further intuition, we can visualise the effect of different adstock alpha values:

raw_spend = np.array([1000, 900, 800, 700, 600, 500, 400, 300, 200, 100, 0, 0, 0, 0, 0, 0])

adstock_spend_1 = geometric_adstock(x=raw_spend, alpha=0.20, l_max=8, normalize=True).eval().flatten()

adstock_spend_2 = geometric_adstock(x=raw_spend, alpha=0.50, l_max=8, normalize=True).eval().flatten()

adstock_spend_3 = geometric_adstock(x=raw_spend, alpha=0.80, l_max=8, normalize=True).eval().flatten()

plt.figure(figsize=(10, 6))

plt.plot(raw_spend, marker='o', label='Raw Spend', color='blue')

plt.fill_between(range(len(raw_spend)), 0, raw_spend, color='blue', alpha=0.2)

plt.plot(adstock_spend_1, marker='o', label='Adstock (alpha=0.20)', color='orange')

plt.fill_between(range(len(adstock_spend_1)), 0, adstock_spend_1, color='orange', alpha=0.2)

plt.plot(adstock_spend_2, marker='o', label='Adstock (alpha=0.50)', color='red')

plt.fill_between(range(len(adstock_spend_2)), 0, adstock_spend_2, color='red', alpha=0.2)

plt.plot(adstock_spend_3, marker='o', label='Adstock (alpha=0.80)', color='purple')

plt.fill_between(range(len(adstock_spend_3)), 0, adstock_spend_3, color='purple', alpha=0.2)

plt.xlabel('Weeks')

plt.ylabel('Spend')

plt.title('Geometric Adstock')

plt.legend()

plt.grid(True)

plt.show()

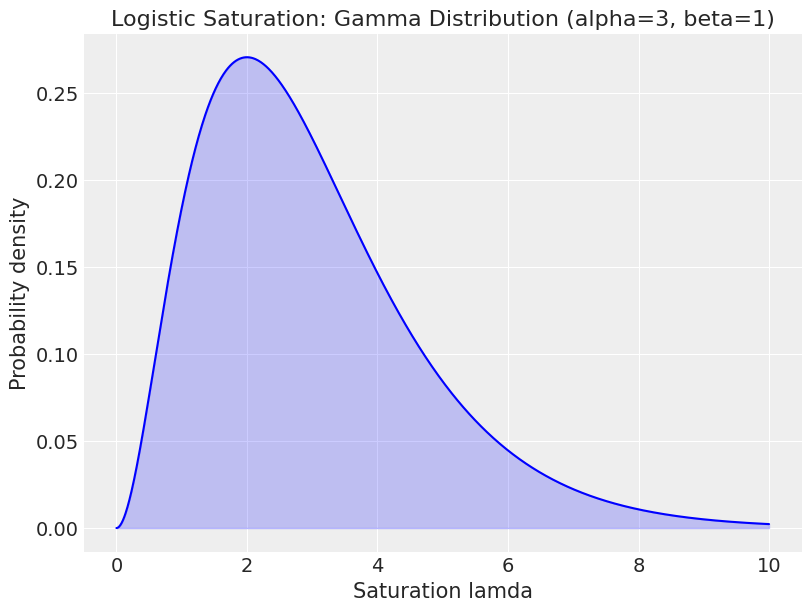

As we increase marketing spend, it’s incremental impact of sales slowly starts to reduce — This is known as saturation. Saturation lamda controls the steepness of the saturation curve, determining how quickly diminishing returns set in.

A gamma distribution is used as a prior for saturation lambda. Let’s start by understanding what a gamma distribution looks like:

alpha = 3

beta = 1

x2 = np.linspace(0, 10, 1000)

y2 = gamma.pdf(x2, alpha, scale=1/beta)

plt.figure(figsize=(8, 6))

plt.plot(x2, y2, 'b-')

plt.fill_between(x2, y2, alpha=0.2, color='blue')

plt.title('Logistic Saturation: Gamma Distribution (alpha=3, beta=1)')

plt.xlabel('Saturation lamda')

plt.ylabel('Probability density')

plt.grid(True)

plt.show()

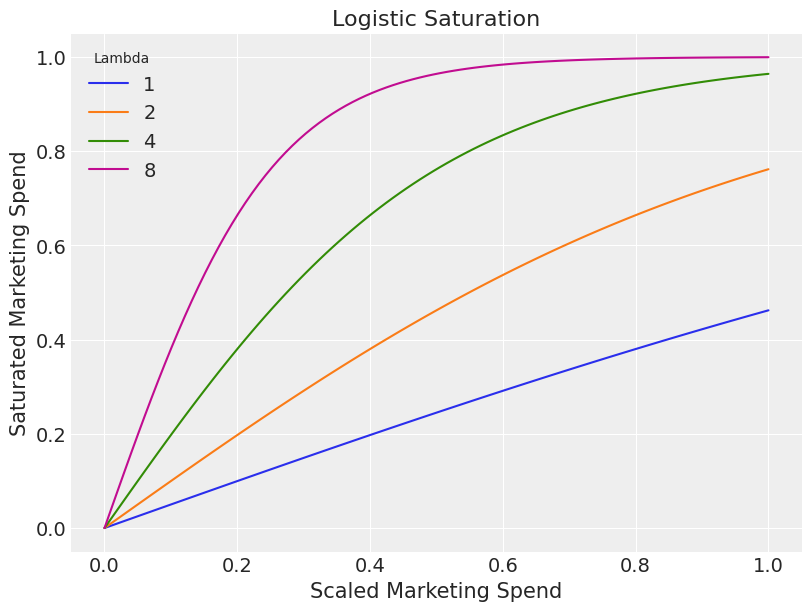

At first glance it can be difficult to understand why the gamma distribution is a sensible choice of prior but plotting the impact of different lamda values helps clarify its appropriateness::

scaled_spend = np.linspace(start=0.0, stop=1.0, num=100)

saturated_spend_1 = logistic_saturation(x=scaled_spend, lam=1).eval()

saturated_spend_2 = logistic_saturation(x=scaled_spend, lam=2).eval()

saturated_spend_4 = logistic_saturation(x=scaled_spend, lam=4).eval()

saturated_spend_8 = logistic_saturation(x=scaled_spend, lam=8).eval()

plt.figure(figsize=(8, 6))

sns.lineplot(x=scaled_spend, y=saturated_spend_1, label="1")

sns.lineplot(x=scaled_spend, y=saturated_spend_2, label="2")

sns.lineplot(x=scaled_spend, y=saturated_spend_4, label="4")

sns.lineplot(x=scaled_spend, y=saturated_spend_8, label="8")

plt.title('Logistic Saturation')

plt.xlabel('Scaled Marketing Spend')

plt.ylabel('Saturated Marketing Spend')

plt.legend(title='Lambda')

plt.grid(True)

plt.show()

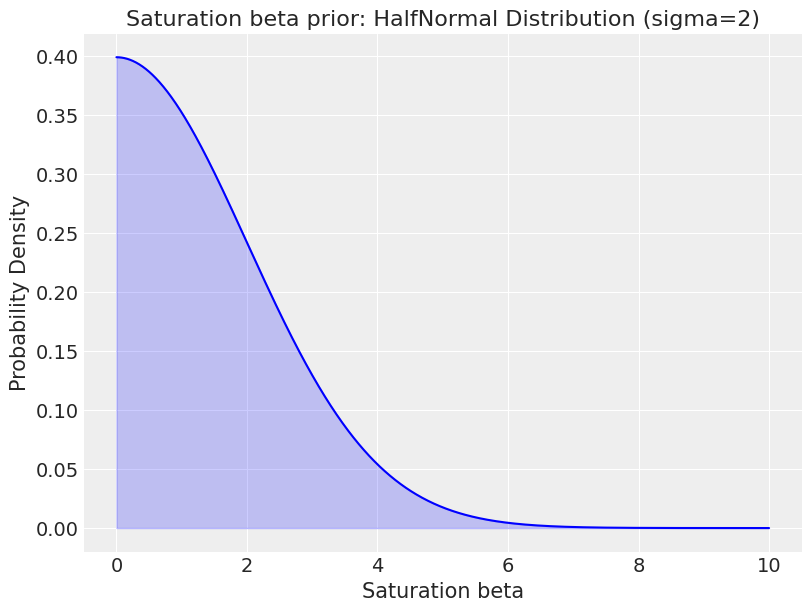

Saturation beta corresponds to the marketing channel coefficient, measuring the impact of marketing spend.

The half-normal prior is used as it enforces positivity which is a very reasonable assumption e.g. marketing shouldn’t have a negative effect. When sigma is set as 2, it tends towards low values. This helps regularize the coefficients, pulling them towards lower values unless there is strong evidence in the data that a particular channel has a significant impact.

sigma = 2

x3 = np.linspace(0, 10, 1000)

y3 = halfnorm.pdf(x3, scale=sigma)

plt.figure(figsize=(8, 6))

plt.plot(x3, y3, 'b-')

plt.fill_between(x3, y3, alpha=0.2, color='blue')

plt.title('Saturation beta prior: HalfNormal Distribution (sigma=2)')

plt.xlabel('Saturation beta')

plt.ylabel('Probability Density')

plt.grid(True)

plt.show()

Remember that both the marketing and target variables are scaled (ranging from 0 to 1), so the beta prior must be in this scaled space.

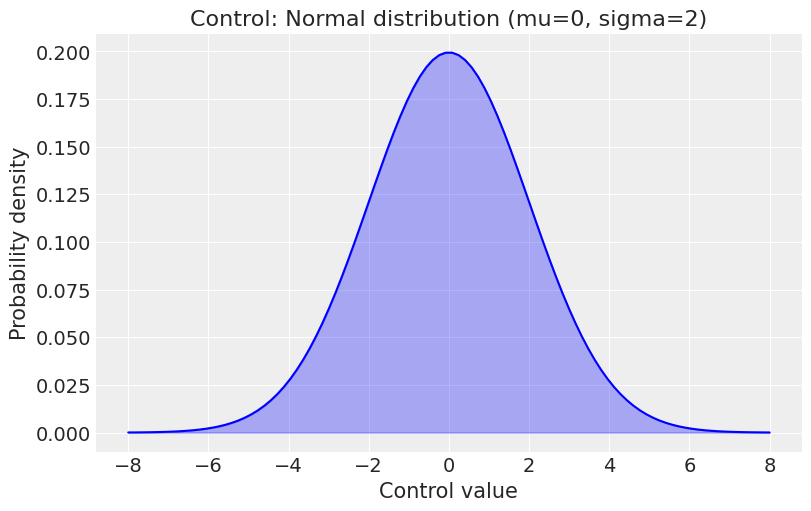

The gamma control parameter is the coefficient for the control variables that account for external factors, such as macroeconomic conditions, holidays, or other non-marketing variables.

A normal distribution is used which allows for both positive and negative effects:

mu = 0

sigma = 2

x = np.linspace(mu - 4*sigma, mu + 4*sigma, 100)

y = norm.pdf(x, mu, sigma)

plt.figure(figsize=(8, 5))

plt.plot(x, y, color='blue')

plt.fill_between(x, y, color='blue', alpha=0.3)

plt.title('Control: Normal distribution (mu=0, sigma=2)')

plt.xlabel('Control value')

plt.ylabel('Probability density')

plt.grid(True)

plt.show()

Control variables are standardized, with values ranging from -1 to 1, so the gamma control prior must be in this scaled space.

Now we have covered some of the theory, let’s but some of it into practice! In this walkthrough we will cover:

The aim is to create some realistic training data where we set the parameters ourselves (adstock, saturation, beta etc.), train and validate a model utilising the pymc-marketing package, and then assess how well our model did at recovering the parameters.

When it comes to real world MMM data, you won’t know the parameters, but this exercise of parameter recovery is a great way to learn and get confident in MMM.

Let’s start by simulating some data to train a model. The benefit of this approach is that we can set the parameters ourselves, which allows us to conduct a parameter recovery exercise to test how well our model performs!

The function below can be used to simulate some data with the following characteristics:

import pandas as pd

import numpy as np

from pymc_marketing.mmm.transformers import geometric_adstock, logistic_saturation

from sklearn.preprocessing import MaxAbsScaler

def data_generator(start_date, periods, channels, spend_scalar, adstock_alphas, saturation_lamdas, betas, freq="W"):

'''

Generates a synthetic dataset for a MMM with trend, seasonality, and channel-specific contributions.

Args:

start_date (str or pd.Timestamp): The start date for the generated time series data.

periods (int): The number of time periods (e.g., days, weeks) to generate data for.

channels (list of str): A list of channel names for which the model will generate spend and sales data.

spend_scalar (list of float): Scalars that adjust the raw spend for each channel to a desired scale.

adstock_alphas (list of float): The adstock decay factors for each channel, determining how much past spend influences the current period.

saturation_lamdas (list of float): Lambda values for the logistic saturation function, controlling the saturation effect on each channel.

betas (list of float): The coefficients for each channel, representing the contribution of each channel's impact on sales.

Returns:

pd.DataFrame: A DataFrame containing the generated time series data, including demand, sales, and channel-specific metrics.

'''

# 0. Create time dimension

date_range = pd.date_range(start=start_date, periods=periods, freq=freq)

df = pd.DataFrame({'date': date_range})

# 1. Add trend component with some growth

df["trend"]= (np.linspace(start=0.0, stop=20, num=periods) + 5) ** (1 / 8) - 1

# 2. Add seasonal component with oscillation around 0

df["seasonality"] = df["seasonality"] = 0.1 * np.sin(2 * np.pi * df.index / 52)

# 3. Multiply trend and seasonality to create overall demand with noise

df["demand"] = df["trend"] * (1 + df["seasonality"]) + np.random.normal(loc=0, scale=0.10, size=periods)

df["demand"] = df["demand"] * 1000

# 4. Create proxy for demand, which is able to follow demand but has some noise added

df["demand_proxy"] = np.abs(df["demand"]* np.random.normal(loc=1, scale=0.10, size=periods))

# 5. Initialize sales based on demand

df["sales"] = df["demand"]

# 6. Loop through each channel and add channel-specific contribution

for i, channel in enumerate(channels):

# Create raw channel spend, following demand with some random noise added

df[f"{channel}_spend_raw"] = df["demand"] * spend_scalar[i]

df[f"{channel}_spend_raw"] = np.abs(df[f"{channel}_spend_raw"] * np.random.normal(loc=1, scale=0.30, size=periods))

# Scale channel spend

channel_transformer = MaxAbsScaler().fit(df[f"{channel}_spend_raw"].values.reshape(-1, 1))

df[f"{channel}_spend"] = channel_transformer .transform(df[f"{channel}_spend_raw"].values.reshape(-1, 1))

# Apply adstock transformation

df[f"{channel}_adstock"] = geometric_adstock(

x=df[f"{channel}_spend"].to_numpy(),

alpha=adstock_alphas[i],

l_max=8, normalize=True

).eval().flatten()

# Apply saturation transformation

df[f"{channel}_saturated"] = logistic_saturation(

x=df[f"{channel}_adstock"].to_numpy(),

lam=saturation_lamdas[i]

).eval()

# Calculate contribution to sales

df[f"{channel}_sales"] = df[f"{channel}_saturated"] * betas[i]

# Add the channel-specific contribution to sales

df["sales"] += df[f"{channel}_sales"]

return df

We can now call the data generator function with some parameters which are realistic:

np.random.seed(10)

# Set parameters for data generator

start_date = "2021-01-01"

periods = 52 * 3

channels = ["tv", "social", "search"]

adstock_alphas = [0.50, 0.25, 0.05]

saturation_lamdas = [1.5, 2.5, 3.5]

betas = [350, 150, 50]

spend_scalars = [10, 15, 20]

df = dg.data_generator(start_date, periods, channels, spend_scalars, adstock_alphas, saturation_lamdas, betas)

# Scale betas using maximum sales value - this is so it is comparable to the fitted beta from pymc (pymc does feature and target scaling using MaxAbsScaler from sklearn)

betas_scaled = [

((df["tv_sales"] / df["sales"].max()) / df["tv_saturated"]).mean(),

((df["social_sales"] / df["sales"].max()) / df["social_saturated"]).mean(),

((df["search_sales"] / df["sales"].max()) / df["search_saturated"]).mean()

]

# Calculate contributions - these will be used later on to see how accurate the contributions from our model are

contributions = np.asarray([

round((df["tv_sales"].sum() / df["sales"].sum()), 2),

round((df["social_sales"].sum() / df["sales"].sum()), 2),

round((df["search_sales"].sum() / df["sales"].sum()), 2),

round((df["demand"].sum() / df["sales"].sum()), 2)

])

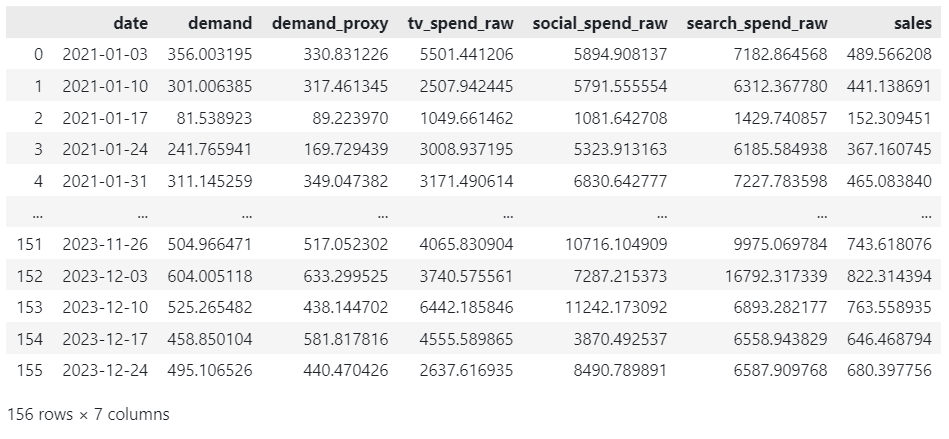

df[["date", "demand", "demand_proxy", "tv_spend_raw", "social_spend_raw", "search_spend_raw", "sales"]]

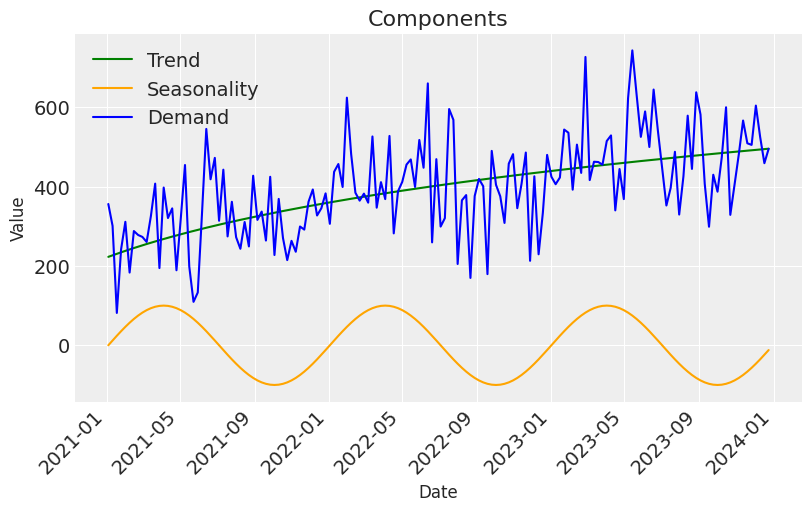

Before we move onto training a model, let’s spend some time understanding the data we have generated.

plt.figure(figsize=(8, 5))

sns.lineplot(x=df['date'], y=df['trend']*1000, label="Trend", color="green")

sns.lineplot(x=df['date'], y=df['seasonality']*1000, label="Seasonality", color="orange")

sns.lineplot(x=df['date'], y=df['demand'], label="Demand", color="blue")

plt.title('Components', fontsize=16)

plt.xlabel('Date', fontsize=12)

plt.ylabel('Value', fontsize=12)

plt.xticks(rotation=45, ha='right')

plt.legend()

plt.show()

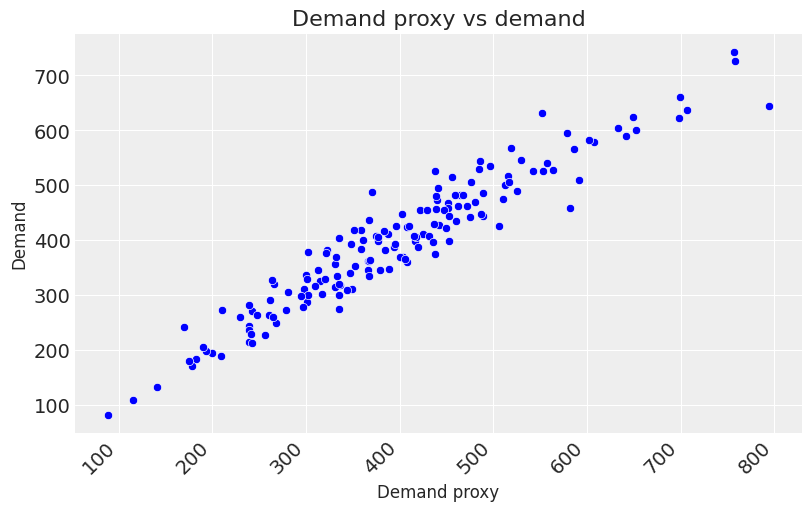

plt.figure(figsize=(8, 5))

sns.scatterplot(x=df['demand_proxy'], y=df['demand'], color="blue")

plt.title('Demand proxy vs demand', fontsize=16)

plt.xlabel('Demand proxy', fontsize=12)

plt.ylabel('Demand', fontsize=12)

plt.xticks(rotation=45, ha='right')

plt.show()

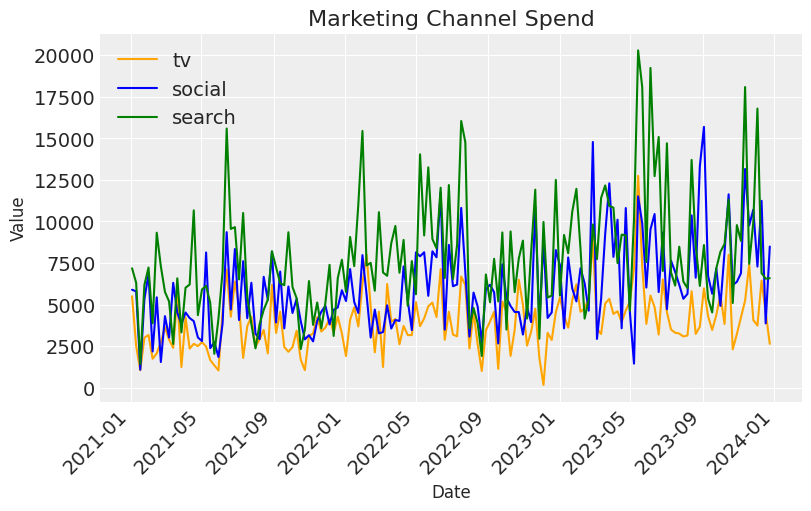

plt.figure(figsize=(8, 5))

sns.lineplot(x=df['date'], y=df['tv_spend_raw'], label=channels[0], color="orange")

sns.lineplot(x=df['date'], y=df['social_spend_raw'], label=channels[1], color="blue")

sns.lineplot(x=df['date'], y=df['search_spend_raw'], label=channels[2], color="green")

plt.title('Marketing Channel Spend', fontsize=16)

plt.xlabel('Date', fontsize=12)

plt.ylabel('Value', fontsize=12)

plt.xticks(rotation=45, ha='right')

plt.legend()

plt.show()

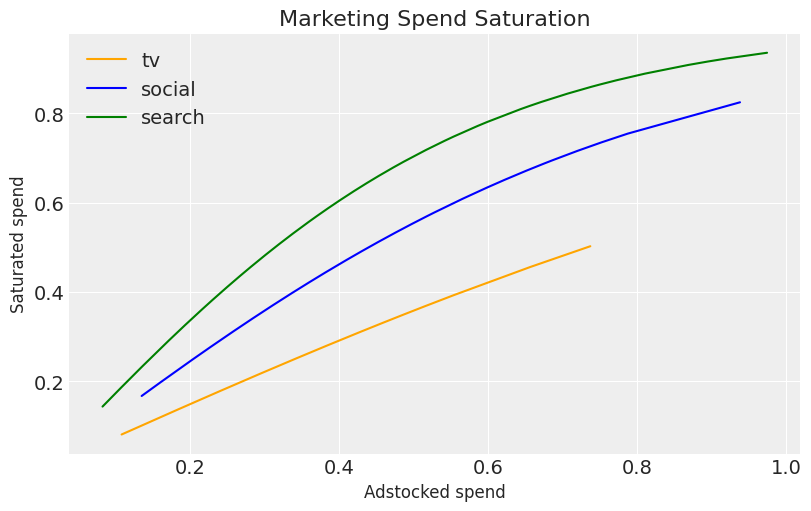

plt.figure(figsize=(8, 5))

sns.lineplot(x=df['tv_adstock'], y=df['tv_saturated'], label=channels[0], color="orange")

sns.lineplot(x=df['social_adstock'], y=df['social_saturated'], label=channels[1], color="blue")

sns.lineplot(x=df['search_adstock'], y=df['search_saturated'], label=channels[2], color="green")

plt.title('Marketing Spend Saturation', fontsize=16)

plt.xlabel('Adstocked spend', fontsize=12)

plt.ylabel('Saturated spend', fontsize=12)

plt.legend()

plt.show()

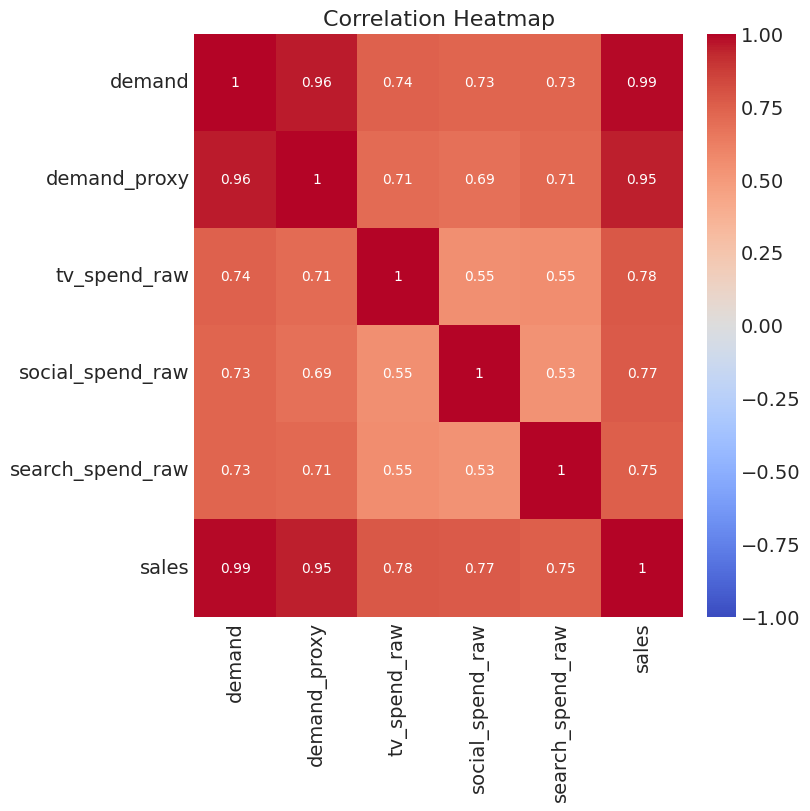

plt.figure(figsize=(8, 8))

sns.heatmap(df[["demand", "demand_proxy", "tv_spend_raw", "social_spend_raw", "search_spend_raw", "sales"]].corr(), annot=True, cmap='coolwarm', vmin=-1, vmax=1)

plt.title('Correlation Heatmap')

plt.show()

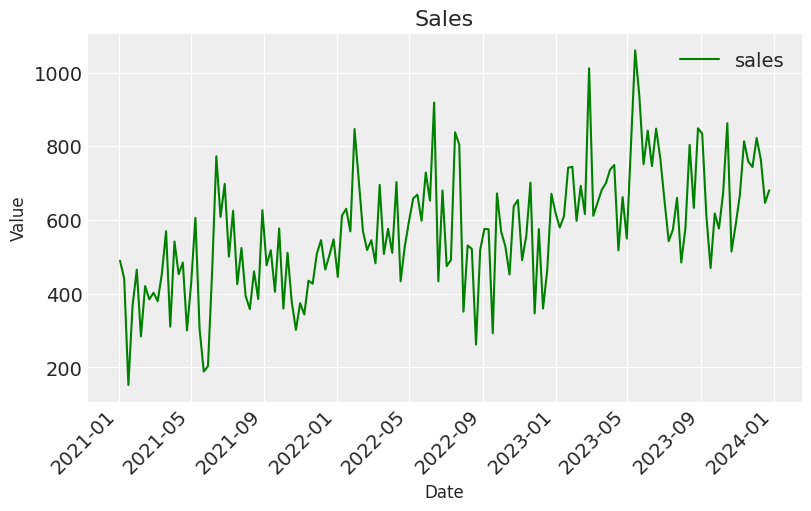

plt.figure(figsize=(8, 5))

sns.lineplot(x=df['date'], y=df['sales'], label="sales", color="green")

plt.title('Sales', fontsize=16)

plt.xlabel('Date', fontsize=12)

plt.ylabel('Value', fontsize=12)

plt.xticks(rotation=45, ha='right')

plt.legend()

plt.show()

Now that we have a good understanding of the data generating process, let’s dive into training the model!

It’s now time to move on to training the model. To begin with we need to prepare the training data by:

# set date column

date_col = "date"

# set outcome column

y_col = "sales"

# set marketing variables

channel_cols = ["tv_spend_raw",

"social_spend_raw",

"search_spend_raw"]

# set control variables

control_cols = ["demand_proxy"]

# split data into features and target

X = df[[date_col] + channel_cols + control_cols]

y = df[y_col]

# set test (out-of-sample) length

test_len = 8

# create train and test indices

train_idx = slice(0, len(df) - test_len)

out_of_time_idx = slice(len(df) - test_len, len(df))

Next we initiate the MMM class. A major challenge in MMM is the fact that the ratio of parameters to training observations is high. One way we can mitigate this is by being pragmatic about the choice of transformations:

To summarise my view here, the more complexity we add to the model, the more we manipulate our marketing spend variables to fit the data which in turn gives us a “better model” (e.g. high R-squared and low mean squared error). But this is at the risk of moving away from the true data generating process which in-turn will give us biased causal effect estimates.

mmm_default = MMM(

adstock=GeometricAdstock(l_max=8),

saturation=LogisticSaturation(),

date_column=date_col,

channel_columns=channel_cols,

control_columns=control_cols,

)

mmm_default.default_model_config

Now let’s fit the model using the train indices. I’ve passed some optional key-word-arguments, let’s spend a bit of time understanding what they do:

fit_kwargs = {

"tune": 1_000,

"chains": 4,

"draws": 1_000,

"target_accept": 0.9,

}

mmm_default.fit(X[train_idx], y[train_idx], **fit_kwargs)

I’d advise sticking with the defaults here, and only changing them if you get some issues in the next steps in terms of divergences.

After fitting the model, the first step is to check for divergences. Divergences indicate potential problems with either the model or the sampling process. Although delving deeply into divergences is beyond the scope of this article due to its complexity, it’s essential to note their importance in model validation.

Below, we check the number of divergences in our model. A result of 0 divergences indicates a good start.

mmm_default.idata["sample_stats"]["diverging"].sum().item()

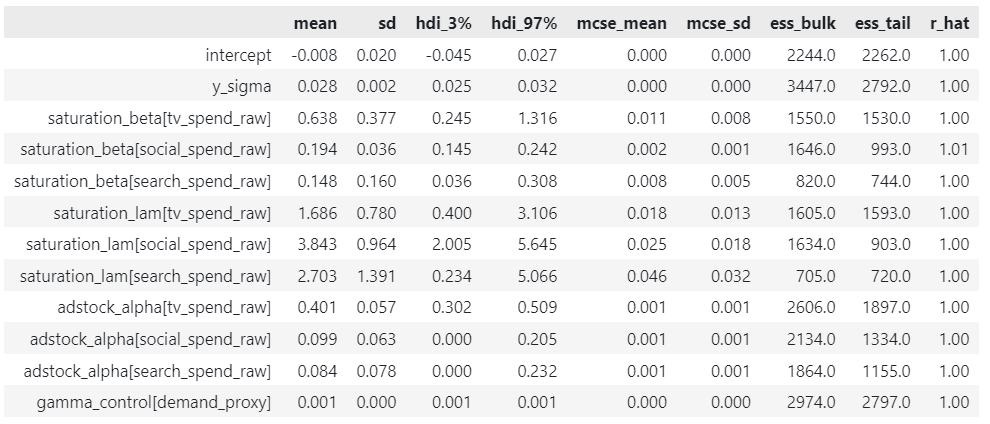

Next we can get a comprehensive summary of the MCMC sampling results. Let’s focus on the key ones:

Our R-hats are all very close to 1, which is expected given the absence of divergences. We will revisit the mean parameter values in the next section when we conduct a parameter recovery exercise.

az.summary(

data=mmm_default.fit_result,

var_names=[

"intercept",

"y_sigma",

"saturation_beta",

"saturation_lam",

"adstock_alpha",

"gamma_control",

],

)

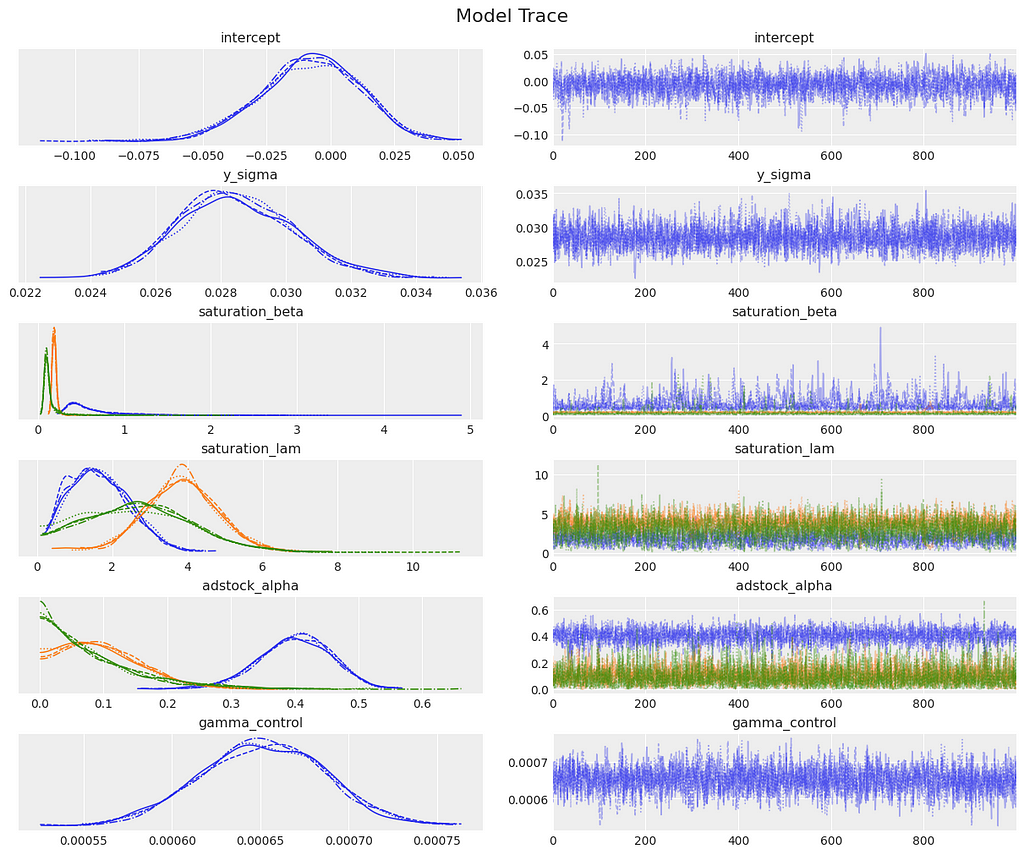

Next, we generate diagnostic plots that are crucial for assessing the quality of our MCMC sampling:

Looking at our diagnostic plots there are no red flags.

_ = az.plot_trace(

data=mmm_default.fit_result,

var_names=[

"intercept",

"y_sigma",

"saturation_beta",

"saturation_lam",

"adstock_alpha",

"gamma_control",

],

compact=True,

backend_kwargs={"figsize": (12, 10), "layout": "constrained"},

)

plt.gcf().suptitle("Model Trace", fontsize=16);

For each parameter we have a distribution of possible values which reflects the uncertainty in the parameter estimates. For the next set of diagnostics, we first need to sample from the posterior. This allows us to make predictions, which we will do for the training data.

mmm_default.sample_posterior_predictive(X[train_idx], extend_idata=True, combined=True)

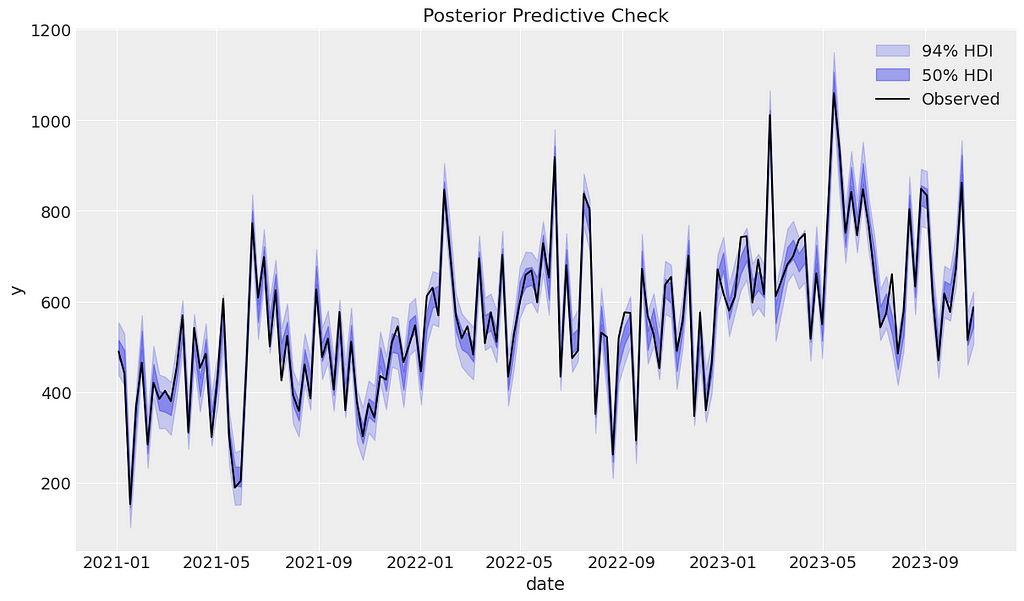

We can begin the posterior predictive checking diagnostics by visually assessing whether the observed data falls within the predicted ranges. It appears that our model has performed well.

mmm_default.plot_posterior_predictive(original_scale=True);

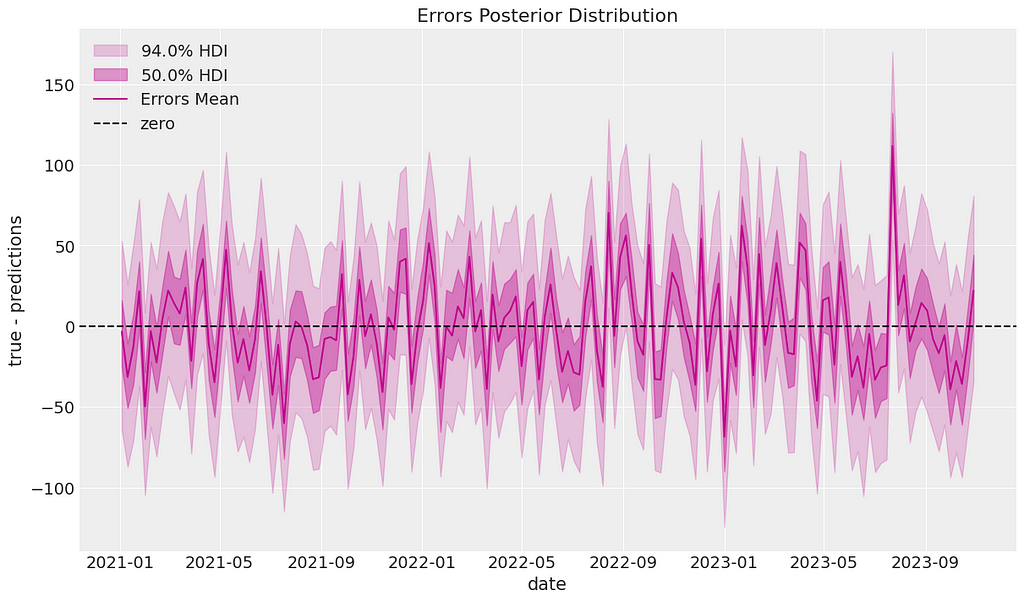

Next we can calculate residuals between the posterior predictive mean and the actual data. We can plot these residuals over time to check for patterns or autocorrelation. It looks like the residuals oscillate around 0 as expected.

mmm_default.plot_errors(original_scale=True);

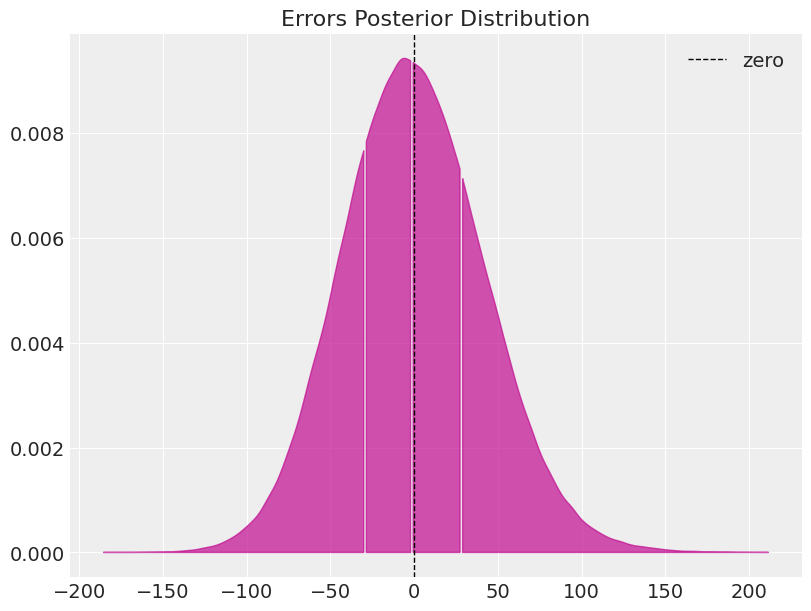

We can also check whether the residuals are normally distributed around 0. Again, we pass this diagnostic test.

errors = mmm_default.get_errors(original_scale=True)

fig, ax = plt.subplots(figsize=(8, 6))

az.plot_dist(

errors, quantiles=[0.25, 0.5, 0.75], color="C3", fill_kwargs={"alpha": 0.7}, ax=ax

)

ax.axvline(x=0, color="black", linestyle="--", linewidth=1, label="zero")

ax.legend()

ax.set(title="Errors Posterior Distribution");

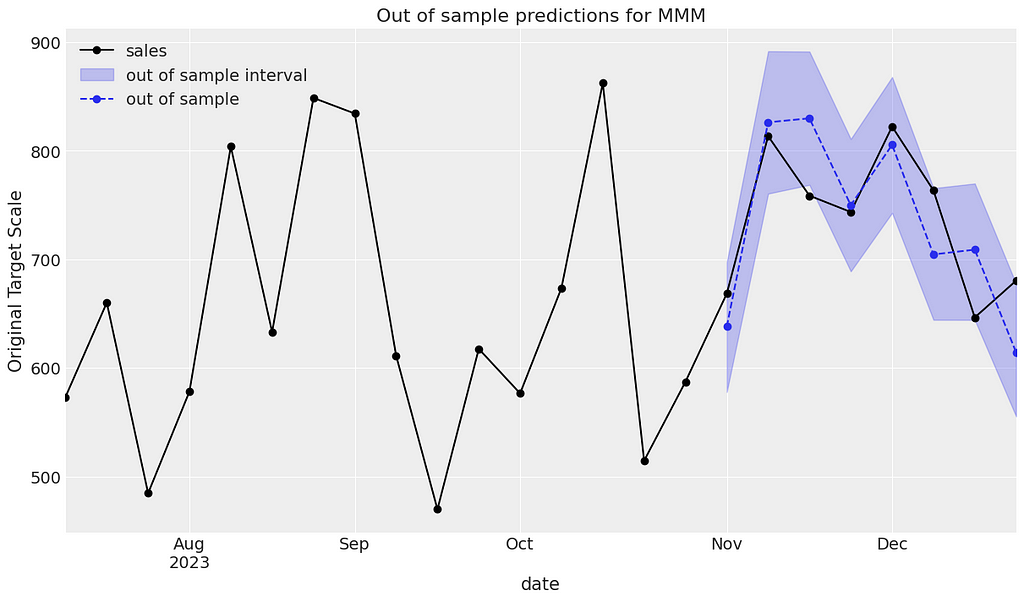

Finally it is good practice to assess how good our model is at predicting outside of the training sample. First of all we need to sample from the posterior again but this time using the out-of-time data. We can then plot the observed sales against the predicted.

Below we can see that the observed sales generally lie within the intervals and the model seems to do a good job.

y_out_of_sample = mmm_default.sample_posterior_predictive(

X_pred=X[out_of_time_idx], extend_idata=False, include_last_observations=True

)

def plot_in_sample(X, y, ax, n_points: int = 15):

(

y.to_frame()

.set_index(X[date_col])

.iloc[-n_points:]

.plot(ax=ax, marker="o", color="black", label="actuals")

)

return ax

def plot_out_of_sample(X_out_of_sample, y_out_of_sample, ax, color, label):

y_out_of_sample_groupby = y_out_of_sample["y"].to_series().groupby("date")

lower, upper = quantiles = [0.025, 0.975]

conf = y_out_of_sample_groupby.quantile(quantiles).unstack()

ax.fill_between(

X_out_of_sample[date_col].dt.to_pydatetime(),

conf[lower],

conf[upper],

alpha=0.25,

color=color,

label=f"{label} interval",

)

mean = y_out_of_sample_groupby.mean()

mean.plot(ax=ax, marker="o", label=label, color=color, linestyle="--")

ax.set(ylabel="Original Target Scale", title="Out of sample predictions for MMM")

return ax

_, ax = plt.subplots()

plot_in_sample(X, y, ax=ax, n_points=len(X[out_of_time_idx])*3)

plot_out_of_sample(

X[out_of_time_idx], y_out_of_sample, ax=ax, label="out of sample", color="C0"

)

ax.legend(loc="upper left");

Based on our findings in this section, we believe we have a robust model. In the next section let’s carry out a parameter recovery exercise to see how close to the ground truth parameters we were.

In the last section, we validated the model as we would in a real-life scenario. In this section, we will conduct a parameter recovery exercise: remember, we are only able to do this because we simulated the data ourselves and stored the true parameters.

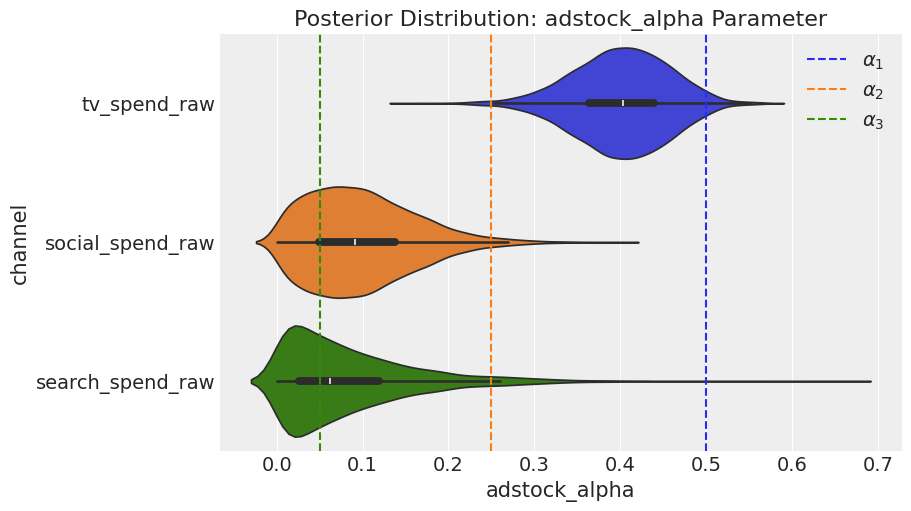

Let’s begin by comparing the posterior distribution of the adstock parameters to the ground truth values that we previously stored in the adstock_alphas list. The model performed reasonably well, achieving the correct rank order, and the true values consistently lie within the posterior distribution.

fig = mmm_default.plot_channel_parameter(param_name="adstock_alpha", figsize=(9, 5))

ax = fig.axes[0]

ax.axvline(x=adstock_alphas[0], color="C0", linestyle="--", label=r"$alpha_1$")

ax.axvline(x=adstock_alphas[1], color="C1", linestyle="--", label=r"$alpha_2$")

ax.axvline(x=adstock_alphas[2], color="C2", linestyle="--", label=r"$alpha_3$")

ax.legend(loc="upper right");

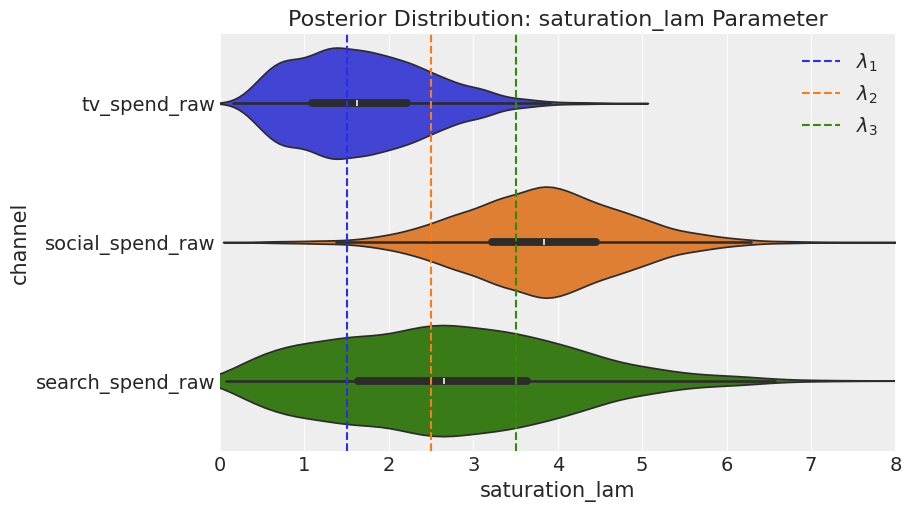

When we examine saturation, the model performs excellently in recovering lambda for TV, but it does not do as well in recovering the true values for social and search, although the results are not disastrous.

fig = mmm_default.plot_channel_parameter(param_name="saturation_lam", figsize=(9, 5))

ax = fig.axes[0]

ax.axvline(x=saturation_lamdas[0], color="C0", linestyle="--", label=r"$lambda_1$")

ax.axvline(x=saturation_lamdas[1], color="C1", linestyle="--", label=r"$lambda_2$")

ax.axvline(x=saturation_lamdas[2], color="C2", linestyle="--", label=r"$lambda_3$")

ax.legend(loc="upper right");

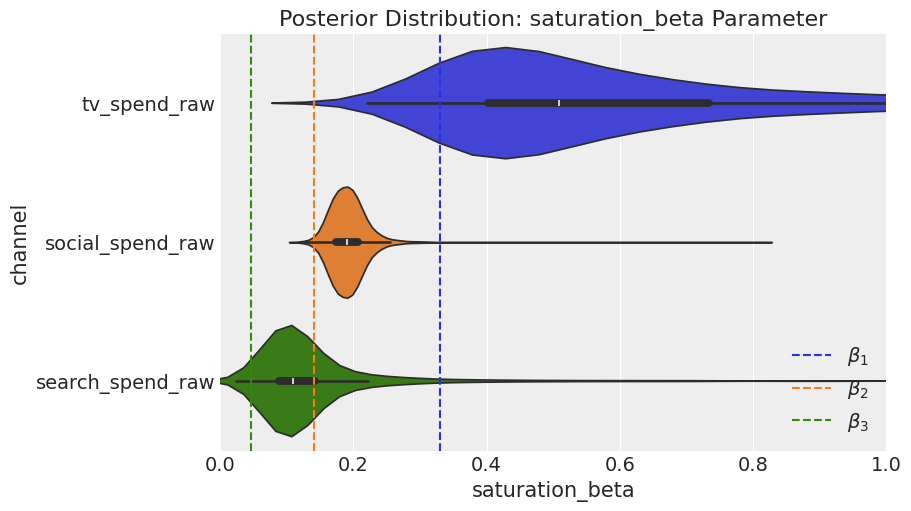

Regarding the channel beta parameters, the model achieves the correct rank ordering, but it overestimates values for all channels. In the next section, we will quantify this in terms of contribution.

fig = mmm_default.plot_channel_parameter(param_name="saturation_beta", figsize=(9, 5))

ax = fig.axes[0]

ax.axvline(x=betas_scaled[0], color="C0", linestyle="--", label=r"$beta_1$")

ax.axvline(x=betas_scaled[1], color="C1", linestyle="--", label=r"$beta_2$")

ax.axvline(x=betas_scaled[2], color="C2", linestyle="--", label=r"$beta_3$")

ax.legend(loc="upper right");

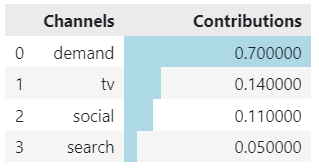

First, we calculate the ground truth contribution for each channel. We will also calculate the contribution of demand: remember we included a proxy for demand not demand itself.

channels = np.array(["tv", "social", "search", "demand"])

true_contributions = pd.DataFrame({'Channels': channels, 'Contributions': contributions})

true_contributions= true_contributions.sort_values(by='Contributions', ascending=False).reset_index(drop=True)

true_contributions = true_contributions.style.bar(subset=['Contributions'], color='lightblue')

true_contributions

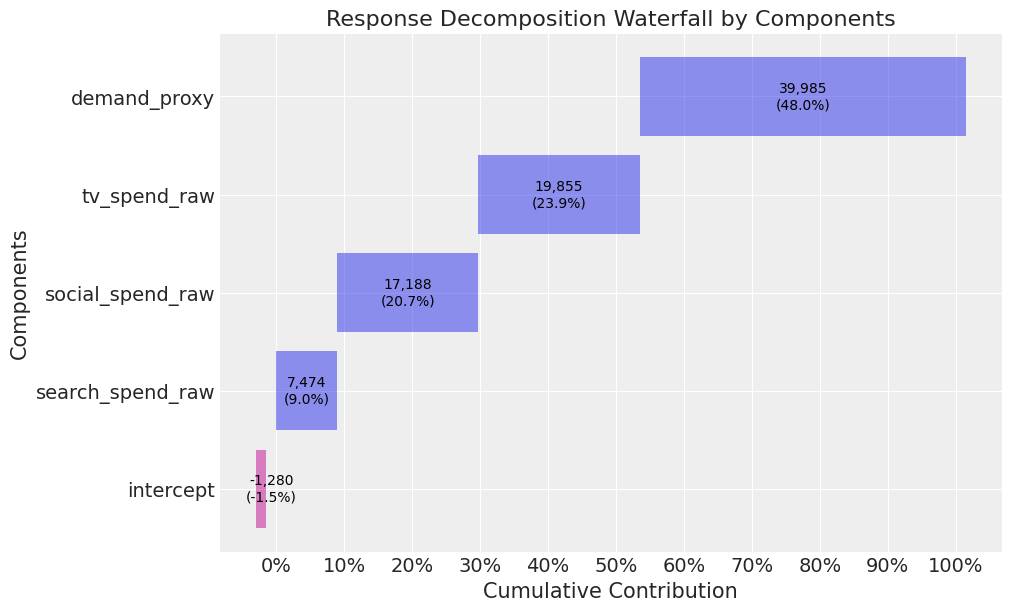

Now, let’s plot the contributions from the model. The rank ordering for demand, TV, social, and search is correct. However, TV, social, and search are all overestimated. This appears to be driven by the demand proxy not contributing as much as true demand.

mmm_default.plot_waterfall_components_decomposition(figsize=(10,6));

In section 2.3, we validated the model and concluded that it was robust. However, the parameter recovery exercise demonstrated that our model considerably overestimates the effect of marketing. This overestimation is driven by the confounding factor of demand. In a real-life scenario, it is not possible to run a parameter recovery exercise. So, how would you identify that your model’s marketing contributions are biased? And once identified, how would you address this issue? This leads us to our next article on calibrating models!

I hope you enjoyed this first instalment! Follow me if you want to continue this path towards mastering MMM — In the next article we will shift our focus to calibrating our models using informative priors from experiments.

Mastering Marketing Mix Modelling In Python was originally published in Towards Data Science on Medium, where people are continuing the conversation by highlighting and responding to this story.

Originally appeared here:

Mastering Marketing Mix Modelling In Python

Go Here to Read this Fast! Mastering Marketing Mix Modelling In Python