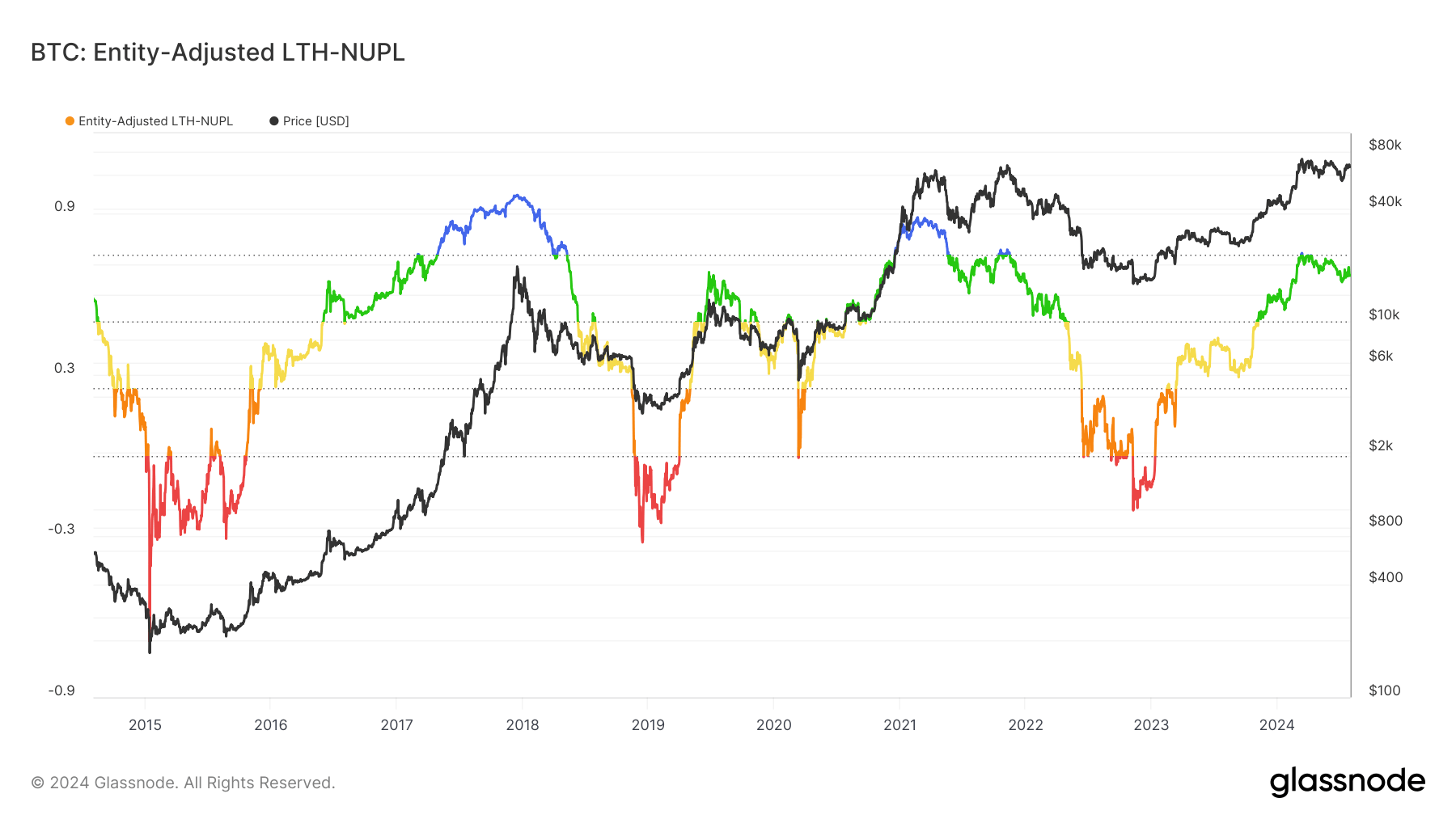

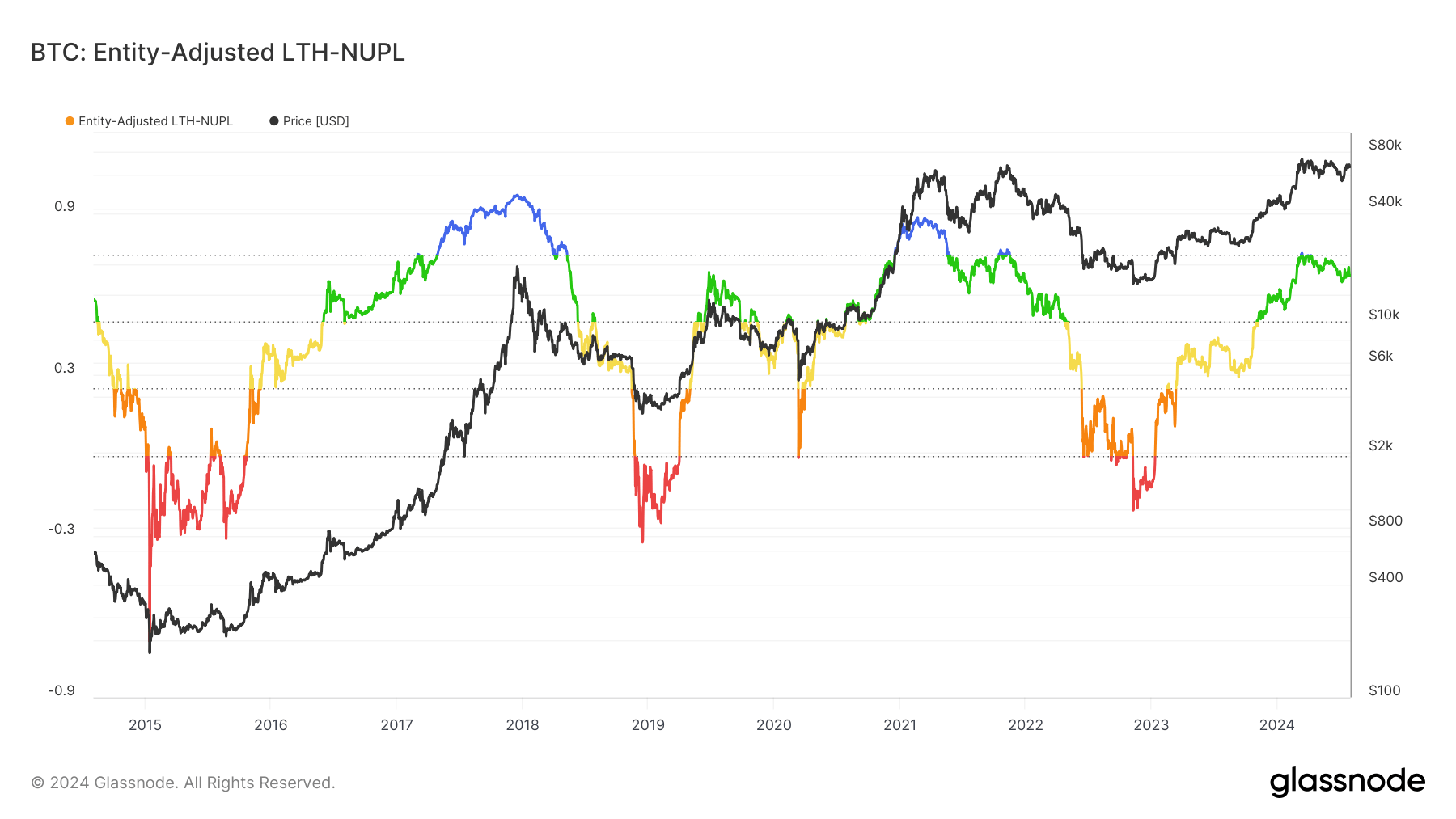

Entity-adjusted Bitcoin metrics provide a refined view of market sentiment by filtering out non-economic transactions. This is especially important when analyzing net unrealized profit and loss, such as the LTH-NUPL and STH-NUPL. Non-entity-adjusted metrics can show skewed, unclear, or incorrect data because they include all transactions, even internal transfers within the same entity. These “in-house” […]

The post NUPL ratio shows why long-term holders are better market top indicators appeared first on CryptoSlate.

Go here to Read this Fast! NUPL ratio shows why long-term holders are better market top indicators

Originally appeared here:

NUPL ratio shows why long-term holders are better market top indicators