Originally appeared here:

European Commission hit by EU court fine after breaking own data privacy rules

Category: Tech News

-

European Commission hit by EU court fine after breaking own data privacy rules

EU General Court hits European Commission with a fine for violating GDPR. -

Shokz debuts OpenFit 2 headphones with beefed-up audio, upgraded controls, and 11 hours of battery life

Shokz has unveiled its new OpenFit 2 headphones for 2025, featuring upgraded audio and a more ergonomic design.

Shokz has unveiled its new OpenFit 2 headphones for 2025, featuring upgraded audio and a more ergonomic design.Originally appeared here:

Shokz debuts OpenFit 2 headphones with beefed-up audio, upgraded controls, and 11 hours of battery life -

Shokz debuts OpenFit 2 headphones with beefed-up audio, upgraded controls, and 11 hours of battery life

Shokz has unveiled its new OpenFit 2 headphones for 2025, featuring upgraded audio and a more ergonomic design.

Shokz has unveiled its new OpenFit 2 headphones for 2025, featuring upgraded audio and a more ergonomic design.Originally appeared here:

Shokz debuts OpenFit 2 headphones with beefed-up audio, upgraded controls, and 11 hours of battery life -

The Samsung Galaxy S25 Ultra could be an even better gaming phone than the S24 Ultra – here’s why

The Samsung Galaxy S25 Ultra could have a better cooling system and improved low-light video skills.Originally appeared here:

The Samsung Galaxy S25 Ultra could be an even better gaming phone than the S24 Ultra – here’s why -

Marvel Rivals will receive hero balance adjustments in the first half of Season 1 to ensure a ‘richer, more engaging, and diverse gaming experience for all’

Marvel Rivals is set to receive plenty of balance changes with the launch of Season 1, NetEase confirms.Marvel Rivals will receive hero balance adjustments in the first half of Season 1 to ensure a ‘richer, more engaging, and diverse gaming experience for all’Marvel Rivals will receive hero balance adjustments in the first half of Season 1 to ensure a ‘richer, more engaging, and diverse gaming experience for all’ -

AMD and Nvidia could be set for epic GPU showdown with RX 9070 and 9070 XT going on sale at the same time as the RTX 5080

AMD RX 9070 and 9070 XT graphics cards might be here sooner than you think – pre-orders could go live on January 23.

AMD RX 9070 and 9070 XT graphics cards might be here sooner than you think – pre-orders could go live on January 23.Originally appeared here:

AMD and Nvidia could be set for epic GPU showdown with RX 9070 and 9070 XT going on sale at the same time as the RTX 5080 -

The Data Scientist’s Dilemma: Answering “What If?” Questions Without Experiments

A hands-on alternative to Google’s Causal Impact

Photo by Vedrana Filipović on Unsplash What is the impact of my last advertising campaign? What are the long-term costs of Brexit? How much has I gained in my new pricing strategy? All these questions are commonly asked of data scientists and other data practitioners (maybe not the one on Brexit, but it is interesting nonetheless). It makes sense because stakeholders are interested in knowing the consequences of their actions.

But, as data scientists, it is generally a tough question for us. On the one hand, these questions could have been answered with more certainty if we had prepared a correct experimental setting before (be it an A/B Test or something better ), but it takes time to create such settings beforehand, and advertisers, supply planners, or pricers don’t generally have the time to do so. On the other hand, such questions force us to confront what remains of our statistical knowledge. We are aware that they are difficult to answer such questions, but it may be hard to pinpoint exactly where they are.

These difficulties may arise in the modelization ( seasonality ? presence of confounders ? ), in the mathematical properties that need to be verified to apply theorems (stationarity ? independence? ), or even in the mathematical-philosophical questions about causation (what is causality and how do you express it the maths ?).

It is therefore not surprising that data scientists have come to use many methods to treat such problems. I do not intend to make a full list of methods. Such a list can for instance be found here . My goal here is to present a simple method that can be used on a lot of cases, provided you have enough history on the data. . I also wish to compare it with Google’s Causal Impact method [1].

The details of the mathematical model has been postponed to their own section, I will try to use as few formulas as possible until then.

The problem

Suppose you have observed some data for a long period (before and after an intervention). We want to know the impact of this modification.

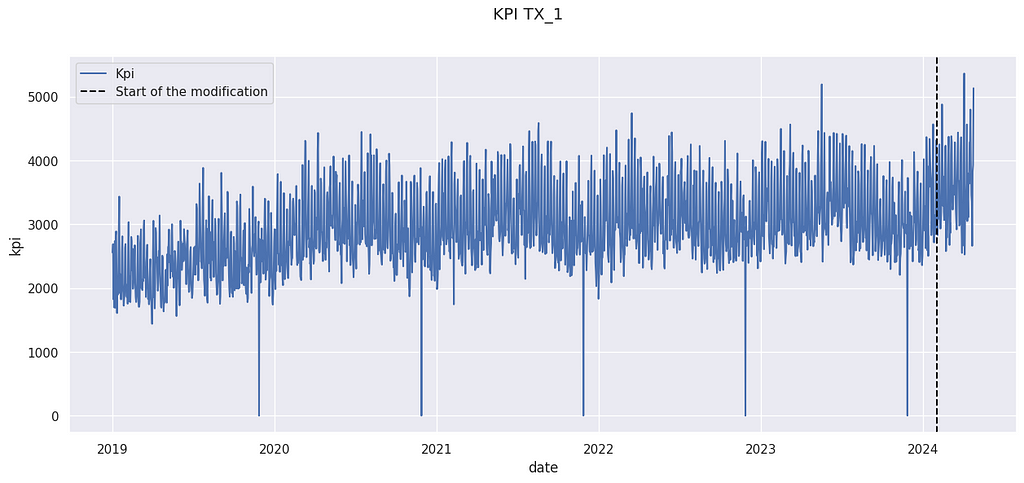

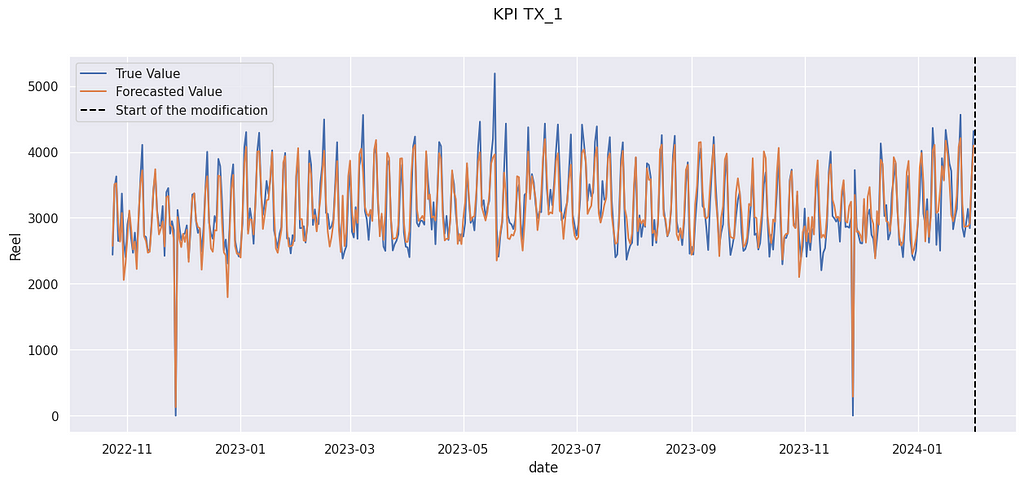

Example KPI (number of sales) The above data come from the M5 Forecasting competition[3], but have been artificially modified. The details are postponed to the last section.

We have observed a KPI Yₜ on a store for a long period. An action has been taken on February 2024. For instance, it could have been the opening of a new competitor in the neighborhood, a new organization of the store, or a change in the pricing strategy. We want to know the impact of this modification.

Remark: This method does not work for punctual change, such as a marketing campaign. Google’s Causal Impact is more adapted in this case.

The proposed method

Let us sketch the method we will use to calculate the impact.

1- We will create a counterfactual prediction based on past data (before the modification). This counterfactual is based on classical ML techniques.

2- We will evaluate the performance of this predictor. This will allow us to compute confidence intervals and to ensure the validity of the use of its prediction.

3 -We will compare the prediction after the modification with the actual value. The prediction will represent what would have happened if the modification hadn’t occurred. Therefore, the difference between the actual value and the prediction is the uplift we measure.

Counterfactual Construction

We want to construct a counterfactual, i.e. a prediction noted Yₜ’ of the KPI Yₜ. There are many ways to construct a counterfactual. You use your favorite ML methods for time series forecasting. However, using classical time series techniques such as ARIMA to construct a counter-factual (a method called C-ARIMA [4]) is complex. Indeed, you cannot use data from after the modification to compute your counterfactual. Therefore, you will need to predict a long horizon with such techniques, and they are generally better ways to do so.

We will present here a simple solution when you have access to a control group. We consider that you have access to similar data not impacted by the modification. In our example, we will use data from other stores. It is therefore analog to a control group. This types of methodologies are called synthetic controls by economists[2], because it creates a synthetic control series instead of taking only one control time series.

X = X.assign(

day_of_the_week = X.reset_index().date.dt.isocalendar().day.values,

trend = (X.reset_index().date- start_modification_date).dt.days.values

)

X.head()magasin CA_1 TX_2 TX_3 WI_1 day_of_the_week trend

date

2019-01-01 4337 3852 3030 2704 2 0

2019-01-02 4155 3937 3006 2194 3 1

2019-01-03 2816 2731 2225 1562 4 2

2019-01-04 3051 2954 2169 1251 5 3

2019-01-05 2630 2492 1726 2 6 4Here we use 4 stores (called CA_1, TX_2, TX_3 and WI_1) in our control features. We also use the day of the week and a trend indicator to train our model. The last one is very handy to limit time drift, which is the main weakness of the method presented in this article.

Note: WI_1 presents an outlier value on 2019–01–05. This is a typical explanation for why we want to have several stores in our control sets, instead of only choosing one store.

min_date =dt.datetime(2019,1,1)

K = 3 # Max order of the fourrier series

T= 365

x = [(i-min_date).days for i in X.index]

XX = np.array([([sin( 2 *k * pi * t /(T-1))for k in range(1, K+1)] +[cos( 2 * pi * k * t /(T-1)) for k in range(1, K+1)] ) for t in x])

X = X.join(pd.DataFrame(XX,columns = [f'F_{i}' for i in range(2*K)], index = X.index))We also add some features corresponding to Fourier coefficients. It is a known technique to integrate seasonalities into ML time series forecasts. It is not really necessary here, but it can improve your results if the data you have present strong seasonal behavior. You may replace them with classical B-spline functions.

Now, we have the features for our model. We will split our data into 3 sets:

1- Training dataset : It is the set of data where we will train our model

2 – Test dataset : Data used to evaluate the performance of our model.

3- After modification dataset: Data used to compute the uplift using our model.

from sklearn.model_selection import train_test_split

start_modification_date = dt.datetime(2024, 2,1)

X_before_modification = X[X.index < start_modification_date]

y_before_modification = y[y.index < start_modification_date].kpi

X_after_modification = X[X.index >= start_modification_date]

y_after_modification = y[y.index >= start_modification_date].kpi

X_train, X_test , y_train , y_test = train_test_split(X_before_modification, y_before_modification, test_size= 0.25, shuffle = False)Note : You can use a fourth subset of data to perform some model selection. Here we won’t do a lot of model selection, so it does not matter a lot. But it will if you start to select your model among tenths of others.

Note 2: Cross-validation is also very possible and recommended.

Note 3 : I do recommend splitting data without shuffling (shuffling = False). It will allow you to be aware of the eventual temporal drift of your model.

from sklearn.ensemble import RandomForestRegressor

model = RandomForestRegressor(min_samples_split=4)

model.fit(X_train, y_train)

y_pred = model.predict(X_test)And here you train your predictor. We use a random forest regressor for its convenience because it allows us to handle non-linearity, missing data, and outliers. Gradients Boosting Trees algorithms are also very good for this use.

Many papers about Synthetic Control will use linear regression here, but we think it is not useful here because we are not really interested in the model’s interpretability. Moreover, interpreting such regression can be tricky.

Counterfactual Evaluation

Our prediction will be on the testing set. The main hypothesis we will make is that the performance of the model will stay the same when we compute the uplift. That is why we tend to use a lot of data in our We consider 3 different key indicators to evaluate the quality of the counterfactual prediction :

1-Bias : Bias controls the presence of a gap between your counterfactual and the real data. It is a strong limit on your ability to compute because it won’t be reduced by waiting more time after the modification.

bias = float((y_pred - y_test).mean()/(y_before_modification.mean()))

bias

> 0.0030433481322823257We generally express the bias as a percentage of the average value of the KPI. It is smaller than 1%, so we should not expect to measure effects bigger than that. If your bias is too big, you should check for a temporal drift (and add a trend to your prediction). You can also correct your prediction and deduce the bias from the prediction, provided you control the effect of this correction of fresh data.

2-Standard Deviation σ: We also want to control how dispersed are the predictions around the true values. We therefore use the standard deviation, again expressed as a percentage of the average value of the kpi.

sigma = float((y_pred - y_test).std()/(y_before_modification.mean()))

sigma

> 0.0780972738325956The good news is that the uncertainty created by the deviation is reduced when the number of data points increase. We prefer a predictor without bias, so it could be necessary to accept an increase in the deviation if allowed to limit the bias.

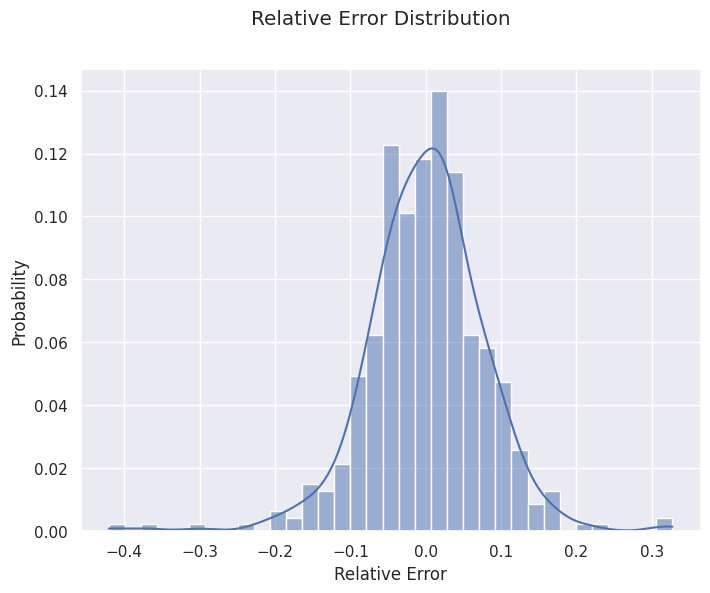

It can also be interesting to look at bias and variance by looking at the distribution of the forecasting errors. It can be useful to see if our calculation of bias and deviation is valid, or if it is affected by outliers and extreme values.

import seaborn as sns

import matplotlib.pyplot as plt

f, ax = plt.subplots(figsize=(8, 6))

sns.histplot(pd.DataFrame((y_pred - y_test)/y_past.mean()), x = 'kpi', bins = 35, kde = True, stat = 'probability')

f.suptitle('Relative Error Distribution')

ax.set_xlabel('Relative Error')

plt.show()

3- Auto-correlation α: In general, errors are auto-correlated. It means that if your prediction is above the true value on a given day, it has more chance of being above the next day. It is a problem because most classical statistical tools require independence between observations. What happened on a given day should affect the next one. We use auto-correlation as a measure of dependence between one day and the next.

df_test = pd.DataFrame(zip(y_pred, y_test), columns = ['Prevision','Real'], index = y_test.index)

df_test = df_test.assign(

ecart = df_test.Prevision - df_test.Real)

alpha = df_test.ecart.corr(df_test.ecart.shift(1))

alpha

> 0.24554635095548982A high auto-correlation is problematic but can be managed. A possible causes for it are unobserved covariates. If for instance, the store you want to measure organized a special event, it could increase its sales for several days. This will lead to an unexpected sequence of days above the prevision.

df_test = pd.DataFrame(zip(y_pred, y_test), columns = ['Prevision','Reel'], index = y_test.index)

f, ax = plt.subplots(figsize=(15, 6))

sns.lineplot(data = df_test, x = 'date', y= 'Reel', label = 'True Value')

sns.lineplot(data = df_test, x = 'date', y= 'Prevision', label = 'Forecasted Value')

ax.axvline(start_modification_date, ls = '--', color = 'black', label = 'Start of the modification')

ax.legend()

f.suptitle('KPI TX_1')

plt.show()

True value and forecasted value on the evaluation set. In the figure above, you can see an illustration of the auto-correlation phenomenon. In late April 2023, for several days, forecasted values are above the true value. Errors are not independent of one another.

Impact Calculation

Now we can compute the impact of the modification. We compare the prediction after the modification with the actual value. As always, it is expressed as a percentage of the mean value of the KPI.

y_pred_after_modification = model.predict(X_after_modification)

uplift =float((y_after_modification - y_pred_after_modification).mean()/y_before_modification.mean())

uplift

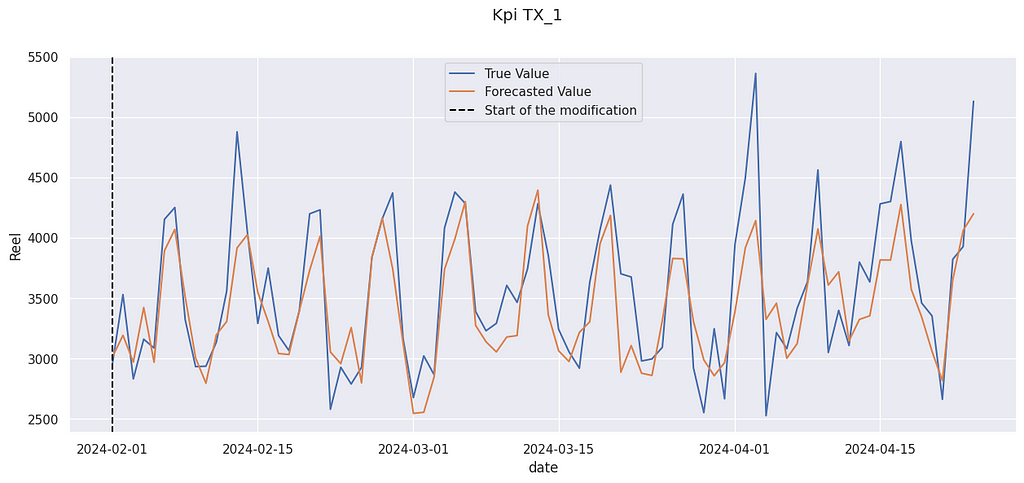

> 0.04961773643584396We get a relative increase of 4.9% The “true” value (the data used were artificially modified) was 3.0%, so we are not far from it. And indeed, the true value is often above the prediction :

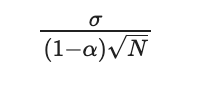

True value and forecasted value after the modification We can compute a confidence interval for this value. If our predictor has no bias, the size of its confidence interval can be expressed with:

Standard deviation of the estimator Where σ is the standard deviation of the prediction, α its auto-correlation, and N the number of days after the modification.

N = y_after_modification.shape[0]

ec = sigma/(sqrt(N) *(1-alpha))

print('68%% IC : [%.2f %% , %.2f %%]' % (100*(uplift - ec),100 * (uplift + ec) ))

print('95%% IC : [%.2f %% , %.2f %%]' % (100*(uplift -2 *ec),100 * (uplift +2*ec) ))68% IC : [3.83 % , 6.09 %]

95% IC : [2.70 % , 7.22 %]The range of the 95% CI is around 4.5% for 84 days. It is reasonable for many applications, because it is possible to run an experiment or a proof of concept for 3 months.

Note: the confidence interval is very sensitive to the deviation of the initial predictor. That is why it is a good idea to take some time to perform model selection (on the training set only) before selecting a good model.

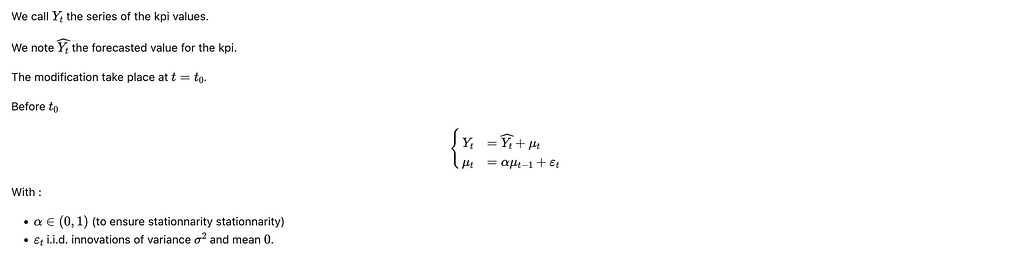

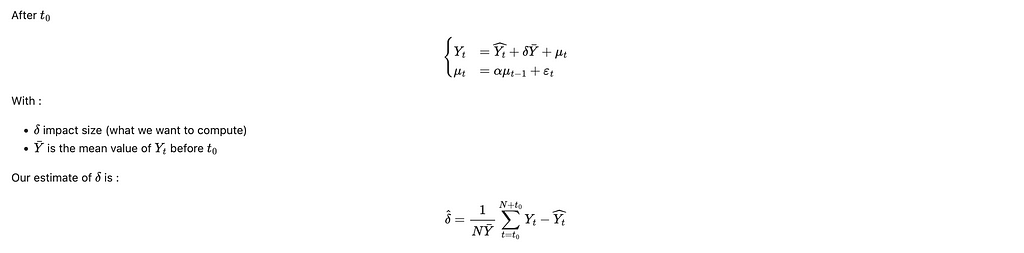

Mathematical formulation of the model

So far we have tried to avoid maths, to allow for an easier comprehension. In this section, we will present the mathematical model beneath the model.

Mathematical model before modification This model is very close to a classical i.i.d. forecasting error. The only difference is that the gap between the forecasted value and the true value follows a stationary AR(1) process. It allows for some auto-correlation to be taken into account.

We are doing the hypothesis is that there is no memory of the previous gap (as in a Markov chain), only a state transition. The knowledge of the current gap is enough to know the distribution of the gap for the next day.

Note: Other mathematical hypotheses (weak dependence ! contraction !) could have been made and will be more general. However, the impact of this hypothesis on the confidence interval will be small, and in practice, the main limitation of this method is the temporal drift, not the model of dependence between variables.

Mathematical model after modification This model leads (with the help of the central limit theorem) to the confidence interval presented before.

Comparison with Causal Impact

Causal Impact is a methodology developed by several Google researchers to answer the general question of impact attribution. It does share some similarities with the model presented here. In particular, they also use a synthetic counterfactual created from several possible control values before the modification.

The main difference is that the model presented here is much more restrictive. The structural time-series model used by Causal allows for a variable impact, whereas we have assumed that this impact was constant. Moreover, seasonality and trend are directly modelized into the Causal Impact framework, which limits the temporal drift and the drawbacks of strong seasonality.

Another difference is that causal impacts allows for some modification on the construction of the synthetic control. It is indeed possible that the behavior of the covariates and the target variables change over time, creating a temporal drift. Causal Impact takes into account some possible modifications, reducing the risk of temporal drift, especially when N is large.

However, our models allow us to use powerful ML Techniques, which can be handy if we have only access to a noisy or partial control. Moreover, by using a tighter hypothesis, we are generally able to establish smaller confidence intervals.

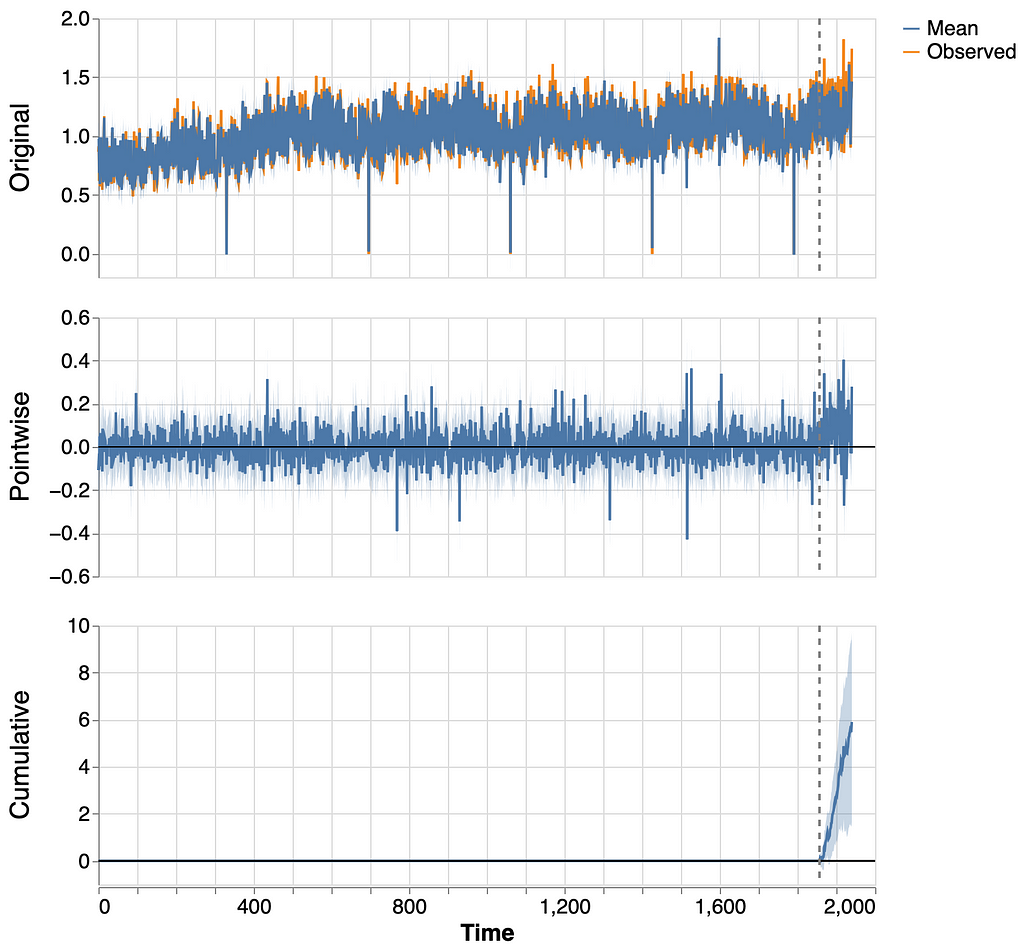

Let’s try to use the Causal Impact models (using the tfp-causalimpact implementation). We use as control variables the 4 same stores as in our examples.

import causalimpact

from causalimpact import DataOptions

import altair as alt

alt.data_transformers.enable("vegafusion") # Useful to compute more than 5000 rows at time in Causal Impact

control = ['CA_1','TX_2', 'TX_3','WI_1']

data = X[control].assign(

y = y.kpi.values /y.kpi.mean()

)

data = data.reset_index().drop(columns = 'date')

training_start = min(data.index)

training_end = X_before_modification.shape[0] - 1

treatment_start = X_before_modification.shape[0]

end_recording = max(data.index)

pre_period = [training_start, training_end]

post_period = [treatment_start, end_recording]

options = DataOptions()

options.outcome_column = 'y'

impact = causalimpact.fit_causalimpact(

data=data,

pre_period=pre_period,

post_period=post_period,

data_options=options

)

causalimpact.plot(impact)

Causal effect observe a significant cumulative effect. Let us compute its statistics.

print(causalimpact.summary(impact, output_format='summary'))

Posterior Inference {CausalImpact}

Average Cumulative

Actual 1.2 101.7

Prediction (s.d.) 1.1 (0.02) 95.8 (2.05)

95% CI [1.1, 1.2] [91.9, 100.0]

Absolute effect (s.d.) 0.1 (0.02) 5.9 (2.05)

95% CI [0.0, 0.1] [1.7, 9.7]

Relative effect (s.d.) 6.2% (2.3%) 6.2% (2.0%)

95% CI [1.7%, 10.6%] [1.7%, 10.6%]

Posterior tail-area probability p: 0.004

Posterior prob. of a causal effect: 99.56%Causal Effect algorithm is also able to detect an effect, but it overestimates it ( 6.2% against the real 3%). Moreover, the range of the 95% CI is 9% (against 4.5% with our method), so it won’t be able to detect really small effects.

Conclusion

To sum up, our methodology works best :

- When we can suppose that the effect we want to measure is constant

- When available control data are noisy, or only partially avalaible

- When there is no trend in our prediction

- With fewer data points (due to the smaller IC)

Causal Impact will work best :

- When the effect we want to measure is not constant

- For times series with strong trend and/or seasonality patterns

- When we have a lot of data points (due to the risk of temporal drift)

Data Sources :

We used data from the M5 Forecasting competition[3]. The data comes from Walmart stores in three US States (California, Texas, and Wisconsin). We only use aggregated sales data from 5 stores :

- TX_1: our target store

- CA_1, TX_2, TX_3 and WI_1 : stores used to construct our synthetic control

The dates are completely fictitious and used mostly to have nice graphic representations.

data = pd.read_csv('sales_train_evaluation.csv')

set_stores = set(data.store_id)

df_list = []

for store in set_stores:

store_total = data[data.store_id == store].iloc[:, 6:].sum(axis= 0).reset_index()

dates = [ dt.datetime(2019,1,1) +dt.timedelta(days =i) for i in range(1941)]

store_total = store_total.assign(magasin = store,date= dates )

store_total.columns = ['dti','kpi', 'magasin', 'date']

df_list.append(store_total)

df = pd.concat(df_list)

target = 'TX_1'

control = ['CA_1','TX_2', 'TX_3','WI_1']

y = df[df.magasin == target].set_index('date')

X = df[df.magasin.isin(control)].set_index(['date','magasin']).kpi.unstack()The target has been artificially modified to introduce a random uplift of mean 3%.

# Falsification :

start_modification_date = dt.datetime(2024, 2,1)

modif_value = 0.03

variance = 0.05

y = y.assign(

random = lambda x: np.random.normal(loc = 1+ modif_value,scale = variance , size = y.shape[0] ),

kpi = lambda x : x.kpi.where(x.index < start_modification_date, other = x.kpi * x.random)

)Complete Code (without plots):

import pandas as pd

import numpy as np

import datetime as dt

import seaborn as sns

import matplotlib.pyplot as plt

from sklearn.model_selection import train_test_split

from sklearn.ensemble import RandomForestRegressor

sns.set_theme()

# Data

data = pd.read_csv('sales_train_evaluation.csv')

set_stores = set(data.store_id)

df_list = []

for store in set_stores:

store_total = data[data.store_id == store].iloc[:, 6:].sum(axis= 0).reset_index()

dates = [ dt.datetime(2019,1,1) +dt.timedelta(days =i) for i in range(1941)]

store_total = store_total.assign(magasin = store,date= dates )

store_total.columns = ['dti','kpi', 'magasin', 'date']

df_list.append(store_total)

df = pd.concat(df_list)

target = 'TX_1'

control = ['CA_1','TX_2', 'TX_3','WI_1']

y = df[df.magasin == target].set_index('date')

X = df[df.magasin.isin(control)].set_index(['date','magasin']).kpi.unstack()

# Falsification :

start_modification_date = dt.datetime(2024, 2,1)

modif_value = 0.03

variance = 0.05

y = y.assign(

random = lambda x: np.random.normal(loc = 1+ modif_value,scale = variance , size = y.shape[0] ),

kpi = lambda x : x.kpi.where(x.index < start_modification_date, other = x.kpi * x.random)

)

# Features constructions

X = X.assign(

day_of_the_week = X.reset_index().date.dt.isocalendar().day.values,

trend = (X.reset_index().date- start_modification_date).dt.days.values

)

min_date =dt.datetime(2019,1,1)

K = 3 # Max order of the fourrier series

T= 365

x = [(i-min_date).days for i in X.index]

XX = np.array([([sin( 2 *k * pi * t /(T-1))for k in range(1, K+1)] +[cos( 2 * pi * k * t /(T-1)) for k in range(1, K+1)] ) for t in x])

X = X.join(pd.DataFrame(XX,columns = [f'F_{i}' for i in range(2*K)], index = X.index))

# Train/Test/AfterIntervention Split

start_modification_date = dt.datetime(2024, 2,1)

X_before_modification = X[X.index < start_modification_date]

y_before_modification = y[y.index < start_modification_date].kpi

X_after_modification = X[X.index >= start_modification_date]

y_after_modification = y[y.index >= start_modification_date].kpi

X_train, X_test , y_train , y_test = train_test_split(X_before_modification, y_before_modification, test_size= 0.25, shuffle = False)

# Model training

model = RandomForestRegressor(min_samples_split=4)

model.fit(X_train, y_train)

y_pred = model.predict(X_test)

# Model Evaluation

bias = float((y_pred - y_test).mean()/(y_before_modification.mean()))

sigma = float((y_pred - y_test).std()/(y_before_modification.mean()))

df_test = pd.DataFrame(zip(y_pred, y_test), columns = ['Prevision','Real'], index = y_test.index)

df_test = df_test.assign(

ecart = df_test.Prevision - df_test.Real)

alpha = df_test.ecart.corr(df_test.ecart.shift(1))

# Uplift Calculation

y_pred_after_modification = model.predict(X_after_modification)

uplift =float((y_after_modification - y_pred_after_modification).mean()/y_before_modification.mean())

N = y_after_modification.shape[0]

ec = sigma/(sqrt(N) *(1-alpha))

print('68%% IC : [%.2f %% , %.2f %%]' % (100*(uplift - ec),100 * (uplift + ec) ))

print('95%% IC : [%.2f %% , %.2f %%]' % (100*(uplift -2 *ec),100 * (uplift +2*ec) ))References :

Unless otherwise noted, all images are by the author.

[1] Kay H. Brodersen. Fabian Gallusser. Jim Koehler. Nicolas Remy. Steven L. Scott., Inferring causal impact using Bayesian structural time-series models (2015), Ann. Appl. Stat.

[2] Matheus Facure Alves, Causal Inference for The Brave and True (2022)

[3] Addison Howard, inversion, Spyros Makridakis, and vangelis. M5 Forecasting — Accuracy. (2020) Kaggle.

[4] Robson Tigre , When and how to apply causal inference in time series (2024) Medium

The Data Scientist’s Dilemma: Answering “What If?” Questions Without Experiments was originally published in Towards Data Science on Medium, where people are continuing the conversation by highlighting and responding to this story.

Originally appeared here:

The Data Scientist’s Dilemma: Answering “What If?” Questions Without Experiments -

This $200 Android is the only smartphone at CES that you should care about

TCL’s CES mobile lineup includes the TCL 60 XE Nxtpaper 5G, an Android handset with a brilliant display and competitive price point.Originally appeared here:

This $200 Android is the only smartphone at CES that you should care about -

How to watch Blue Origin’s New Glenn rocket launch for the first time

Blue Origin is making final preparations for the maiden launch of its heavy-lift New Glenn rocket.Go Here to Read this Fast! How to watch Blue Origin’s New Glenn rocket launch for the first time

Originally appeared here:

How to watch Blue Origin’s New Glenn rocket launch for the first time -

The best docking stations for laptops in 2025

Laptops have long rivaled desktops in terms of power. But those slim and portable machines lack something their tower-shaped cousins tend to have in abundance: ports. Docking stations let you plug in monitors, mice, keyboards, storage devices and more using just a single port on your laptop. And if you’re someone who relocates with your laptop often, a docking station makes it easier to get all your accessories connected again when you’re back at your desk. We tested out more than 15 highly rated docking stations and considered monitor support, number and type of ports, design and price to help you determine which one is the best docking station for your home or office setup.

Table of contents

Best docking stations

What to look for in a docking station

First and foremost, consider what you need to plug in. This will likely be the deciding factor when you go to actually buy a docking station. Do you need three screens for an expanded work view? A quick way to upload photos from an SD card? Are you looking to plug in a webcam, mic and streaming light, while simultaneously taking advantage of faster Ethernet connections? Are you hooking up a gaming laptop to multiple displays and peripherals? Once you’ve settled on the type of ports you need, you may also want to consider the generation of those ports as well; even ports with the same shape can have different capabilities. Here’s a brief overview of the connectivity different docking stations offer.

Monitor ports

External monitors typically need one of three ports to connect to a PC: HDMI, DisplayPort or USB-C. HDMI connections are more common than DisplayPort and the cables and devices that use them are sometimes more affordable. The most popular version of the DisplayPort interface (v1.4) can handle higher resolutions and refresh rates than the most common HDMI version (2.0). All of the display docking stations with HDMI ports that we recommend here use version 2.0, which can handle 4K resolution at 60Hz or 1080p up to 240Hz. The DisplayPort-enabled docks support either version 1.2, which allows for 4K resolution at 60Hz, or version 1.4, which can handle 8K at 60Hz or 4K at 120Hz.

You can also use your dock’s downstream (non-host) Thunderbolt ports to hook up your monitors. If your external display has a USB-C socket, you can connect directly. If you have an HDMI display or DisplayPort-only monitor, you can use an adapter or a conversion cable.

Of course, the number of monitors you can connect and the resolutions/rates they’ll achieve depend on both your computer’s GPU and your monitors — and the more monitors you plug in can bring down those numbers as well. Be sure to also use cables that support the bandwidth you’re hoping for. MacOS users should keep in mind that MacBooks with the standard M1 or M2 chips support just one external monitor natively and require DisplayLink hardware and software to support two external displays. MacBooks with M1 Pro, M2 Pro or M2 Max chips can run multiple monitors from a single port.

USB ports

Most docking stations offer a few USB Type-A ports, which are great for peripherals like wired mice and keyboards, bus-powered ring lights and flash drives. For faster data transfer speeds to your flash drive, go for USB-A sockets labeled 3.1 or 3.2 — or better yet, use a USB-C Thunderbolt port.

Type-C USB ports come in many different flavors. The Thunderbolt 3, 4 and USB4 protocols are newer, more capable specifications that support power delivery of up to 100W, multiple 4K displays and data transfer speeds of up to 40Gbps. Other USB-C ports come in a range of versions, with some supporting video, data and power and some only able to manage data and power. Transfer rates and wattages can vary from port to port, but most docks list the wattage or GB/s on either the dock itself or on the product page. And again, achieving the fastest speeds will depend on factors like the cables you use and the devices you’re transferring data to.

Nearly every dock available today is a USB-C docking station, connecting to a computer via USB-C, often Thunderbolt, and those host ports are nearly always labeled with a laptop icon. They also allow power delivery to your laptop: available wattage varies, but most docks are rated between 85 and 100 watts. That should be enough to keep most computers powered — and it also means you won’t have to take up an extra laptop connector for charging.

Other ports

None of our currently recommended laptops include an Ethernet jack; a docking station is a great way to get that connection back. We all know objectively that wired internet is faster than Wi-Fi, but it might take running a basic speed comparison test to really get it on a gut level. For reference, on Wi-Fi I get about a 45 megabit-per-second download speed. Over Ethernet, it’s 925 Mbps. If you pay for a high-speed plan, but only ever connect wirelessly, you’re probably leaving a lot of bandwidth on the table. Every docking station I tested includes an Ethernet port, and it could be the connector you end up getting the most use out of.

Just two of our favorite laptops have SD card readers, and if you need a quick way to upload files from cameras or audio recorders, you may want to get a dock with one of those slots. Of the docks we tested, about half had SD readers. For now, most (but not all) laptops still include a 3.5mm audio jack, but if you prefer wired headphones and want a more accessible place to plug them in, many docking stations will provide.

When you’re counting up the ports for your new dock, remember that most companies include the host port (the one that connects to your computer) in the total number. So if you’re looking for a dock with three Thunderbolt connections, be sure to check whether one of them will be used to plug in your laptop.

Design

Most docking stations have either a lay-flat or upright design. Most docks put the more “permanent” connections in back — such as Ethernet, DC power, monitor connections and a few USBs. Up-front USB ports can be used for flash drive transfers, or even acting as a charger for your phone (just make sure the port can deliver the power you need). USBs in the rear are best for keyboards, mice, webcams and other things you’re likely to always use. Some docks position the host port up front, which might make it easier to plug in your laptop when you return to your desk, but a host port in back may look neater overall.

How we tested docking stations

We started out by looking at online reviews, spec sheets from various brands and docking stations that our fellow tech sites have covered. We considered brands we’ve tested before and have liked, and weeded out anything that didn’t have what we consider a modern suite of connections (such as a dock with no downstream USB-C ports). We narrowed it down to 12 contenders and I tested each dock in a home office, using an M1 MacBook Pro, a Dell XPS 13 Plus and an Acer Chromebook Spin 514.

I plugged in and evaluated the quality of the connections for 12 different peripherals including a 4K and an HD monitor, a 4K and an HD webcam, plus USB devices like a mouse, keyboard, streaming light and mic. I plugged in wired earbuds, and transferred data to a USB-C flash drive and an external SSD. I ran basic speed tests on the Ethernet connections as well as the file transfers. I judged how easy the docks were to use as well as the various design factors I described earlier. I made spreadsheets and had enough wires snaking around my work area that my cat stayed off my desk for three weeks (a new record).

As new docking stations come out and we find models worthy of testing, (there are a couple from Ugreen we have our eye on), we’ll update this guide accordingly.

Other laptop docking stations we tested

Plugable TBT4-UDZ

When I pulled the Plugable TBT4-UDZ Thunderbolt 4 out of the box, I was convinced it would make the cut: It has a practical upright design, an attractive metal finish, and the host connection is TB4. While there are plenty of USB-A and monitor ports, there’s just one downstream USB-C. A modern dock, particularly one that costs $300, should let you run, say, a USB-C cam and mic at the same time. Otherwise, it’s pretty limiting.

Anker 575 USB-C

At $250 (and more often $235), the Anker 575 USB-C could make for a good budget pick for Windows. It performed well with the Dell XPS 13 Plus, but had trouble with the third screen, the 4K webcam and headphone jack when connected to the MacBook Pro. It’s quite compact, which means it can get wobbly when a bunch of cables are plugged in, but it has a good selection of ports and was able to handle my basic setup well.

Belkin Connect Pro Thunderbolt 4

Belkin’s Connect Pro Thunderbolt 4 Dock is a contender for a Thunderbolt 4 alternative. It has nearly the same ports as the AD2010 (minus the microSD slot) and an attractive rounded design — but it’s $90 more, so I’d only recommend getting it if you find it on sale.

Acer USB Type-C Dock

Acer’s USB Type-C Dock D501 costs $10 more than our Kensington pick for Chromebooks, but it performs similarly and is worth a mention. It has nearly the same ports (including the rather limiting single downstream USB-C) but both the Ethernet and data transfer speeds were faster.

Docking station FAQs

Are docking stations worth it?

Docking stations are worth it if you have more accessories to plug in than your laptop permits. Say you have a USB-C camera and mic, plus a USB-A mouse, keyboard and streaming light; very few modern laptops have enough connections to support all of that at once. A docking station can make that setup feasible while also giving you extra ports like a gigabit Ethernet connection, and supplying power to your laptop. However, if you just need a few extra USB sockets, you might be better off going with a hub, as those tend to be cheaper.

How much does a laptop dock cost?

Laptop docking stations tend to be bigger and more expensive than simple USB-A or USB-C hubs, thanks to the wider array of connections. You can find them as low as $50 and they can get as expensive as $450. A reasonable price for a dock with a good selection of ports from a reputable brand will average around $200.

How do I set up my laptop dock?

Most docking stations are plug and play. First, connect the DC power cable to the dock and a wall outlet. Then look for the “host” or upstream port on the dock — it’s almost always a USB-C/Thunderbolt port and often branded with an icon of a laptop. Use the provided cable to connect to your computer. After that, you can connect your peripherals to the dock and they should be ready to use with your laptop. A few docking stations, particularly those that handle more complex monitor setups, require a driver. The instructions that come with your dock will point you to a website where you can download that companion software.

Does a laptop charge on a docking station?

Nearly all docking stations allow you to charge your laptop through the host connection (the cable running from the dock to your computer). That capability, plus the higher number of ports is what separates a docking station from a hub. Docks can pass on between 65W and 100W of power to laptops, and nearly all include a DC adapter.

Are all docking stations compatible with all laptops?

No, not all docking stations are compatible with every laptop. In our tests, the Chromebook had the biggest compatibility issues, the Dell PC had the least, and the MacBook fell somewhere in between. All docks will list which brands and models they work with on the online product page — be sure to also check the generation of your laptop as some docks can’t support certain chips.

What are some popular docking station brands?

Kensington, Anker, Pluggable and Belkin are reputable and well-known brands making docking stations for all laptops. Lenovo, Dell and HP all make docks that will work with their own computers as well as other brands.

This article originally appeared on Engadget at https://www.engadget.com/computing/accessories/best-docking-station-160041863.html?src=rss

Go Here to Read this Fast! The best docking stations for laptops in 2025

Originally appeared here:

The best docking stations for laptops in 2025