Originally appeared here:

Unlocking generative AI for enterprises: How SnapLogic powers their low-code Agent Creator using Amazon Bedrock

Originally appeared here:

Unlocking generative AI for enterprises: How SnapLogic powers their low-code Agent Creator using Amazon Bedrock

Originally appeared here:

Next-generation learning experience using Amazon Bedrock and Anthropic’s Claude: Innovation from Classworks

Originally appeared here:

Fine-tune a BGE embedding model using synthetic data from Amazon Bedrock

Go Here to Read this Fast! Fine-tune a BGE embedding model using synthetic data from Amazon Bedrock

Originally appeared here:

Boost post-call analytics with Amazon Q in QuickSight

Go Here to Read this Fast! Boost post-call analytics with Amazon Q in QuickSight

Originally appeared here:

Create a next generation chat assistant with Amazon Bedrock, Amazon Connect, Amazon Lex, LangChain, and WhatsApp

When developing a machine learning project in an industry, data scientists and ML engineers are often the primary roles highlighted. However, in reality, it takes a village to deliver the product. In a previous article, we discussed the steps involved in developing a fraud prediction product using machine learning. In this article, we will explore the various roles in such a project and how each contributes to its success. Disclaimer: Not all projects will necessarily have teams or individuals with the exact titles listed below; depending on the company structure, one person may wear multiple hats and fulfill several roles. Here, I outline the structure based on my experience of working on different fraud prediction projects with ML/AI.

The project manager’s role is both critical and challenging. They are responsible for the project’s plan and its execution. At the beginning of the project, they help define the plan and set deadlines based on stakeholders’ requests and the technical team’s capacities. Throughout the project, they constantly monitor progress. If the actual state of tasks or deliveries deviates from the plan, they need to raise a flag and coordinate with the teams. As a result, they spend most of their time communicating with different teams, higher-level managers, and business stakeholders. Two major challenges in their job are:

By effectively managing these challenges, project managers play a pivotal role in the successful delivery of machine learning projects.

Fraud analysts’ domain expertise and knowledge are crucial for the development and evaluation of fraud prediction models. From the beginning of the project, they provide insights into active fraud trends, common fraudulent scenarios, and red flags, as well as exceptions or “green flags.” Data scientists incorporate this knowledge during the feature creation/engineering phase. Once the model is running in production, constant monitoring is required to maintain or improve performance. At this stage, fraud analysts are essential in identifying the model’s true or false positives. This identification can result from a thorough investigation of the customer’s history or by contacting the customer for confirmation. The feedback from fraud analysts is integral to the feedback loop process.

High-level managers and C-level executives play a crucial role in the success of ML/AI fraud projects. Their support is essential for removing obstacles and building consensus on the project’s strategic direction. Therefore, they need to be regularly updated about the project’s progress. So that they can support championing investments in necessary teams, tools, and processes based on the project’s specific requirements and ensure appropriate resources are allocated. Additionally, they are responsible for holding internal and external parties accountable for data privacy and compliance with industry standards. By fostering a culture of accountability and providing clear leadership, they help ensure that the project meets its goals and integrates smoothly with the organization’s overall strategy. Their involvement is vital for addressing any regulatory concerns, managing risk, and driving the project toward successful implementation and long-term sustainability.

Data engineers provide the data needed for us (data scientists) to build models, which is an essential step in any ML project. They are responsible for designing and maintaining data pipelines, whether for real-time data streams or batch processes in data warehouses. Involved from the project’s inception, data engineers identify data requirements, sources, processing needs, and SLA requirements for data accessibility.

They build pipelines to collect, transform, and store data from various sources, essentially handling the ETL process. They also manage and maintain these pipelines, addressing scalability requirements, monitoring data quality, optimizing queries and processes to improve latency, and reducing costs.

On paper, data scientists create machine learning algorithms to predict various types of information for the business. In reality, we wear many different hats throughout the day. We start by identifying the business problem, understanding the data and available resources, and defining a solution, translating it into technical requirements.

Data scientists collaborate closely with data engineers and MLOps engineers to implement solutions. We also work with business stakeholders to communicate results and receive feedback. Model evaluation is another critical responsibility, which involves selecting proper metrics to assess the model’s performance, continuously monitoring and reporting on it, and watching for any decay in performance.

The process of continuous improvement is central to a data scientist’s role, to ensure that models remain accurate and relevant over time.

Once data engineers and data scientists build the data pipelines and model, it’s time to put the model into production. MLOps engineers play a crucial role in this phase by bridging the gap between development and operations. In the context of fraud prediction, timing is critical since the business needs to prevent fraud before it happens, necessitating a pipeline process that runs in less than a second. Therefore, Mlops engineers ensure that models are seamlessly integrated into production environments, maintaining reliability and scalability. MLOps engineers design and manage the infrastructure needed for model deployment, implement continuous integration and continuous deployment (CI/CD) pipelines, and monitor model performance in real-time. They also handle version control, automate testing, and manage model retraining processes to keep models up-to-date. By addressing these operational challenges, MLOps engineers enable the smooth and efficient deployment of machine learning models, ensuring they deliver consistent and valuable outcomes for the business.

We talked about the roles I have identified in my working experience. These roles interact differently depending on the stage of the project and each specific company. In my experience, in the begining of the project, fraud analysts, high level managers and data scientists work together to define the strategy and requirements. Data scientist’s play a significant role in identifying the business problem. They collaborate with Mlops and Engineering to translate it into a technical solution. Data engineers need to come along to discuss required pipeline developments. One common challenge is when there is a disconnect between these teams and it just emerges at the time of execution. This can impact timelines and the quality of the deliverable. Therefore the more integrity between these teams, the smoother will be the implementation and delivery.

Comment below about the roles in your company. How are things different in your experience?

Key Roles in a Fraud Prediction project with Machine Learning was originally published in Towards Data Science on Medium, where people are continuing the conversation by highlighting and responding to this story.

Originally appeared here:

Key Roles in a Fraud Prediction project with Machine Learning

Go Here to Read this Fast! Key Roles in a Fraud Prediction project with Machine Learning

Machine learning (ML) model training typically follows a familiar pipeline: start with data collection, clean and prepare it, then move on to model fitting. But what if we could take this process further? Just as some insects undergo dramatic transformations before reaching maturity, ML models can evolve in a similar way (see Hinton et al. [1]) — what I will call the ML metamorphosis. This process involves chaining different models together, resulting in a final model that achieves significantly better quality than if it had been trained directly from the start.

Here’s how it works:

You may already be familiar with this concept from knowledge distillation, where a smaller neural network replaces a larger one. But ML metamorphosis goes beyond this, and neither the initial model (Model A) nor the final one (Model B) need be neural networks at all.

Imagine you’re tasked with training a multi-class decision tree on the MNIST dataset of handwritten digit images, but only 1,000 images are labelled. You could train the tree directly on this limited data, but the accuracy would be capped at around 0.67. Not great, right? Alternatively, you could use ML metamorphosis to improve your results.

But before we dive into the solution, let’s take a quick look at the techniques and research behind this approach.

Even if you haven’t used knowledge distillation, you’ve probably seen it in action. For example, Meta suggests distilling its Llama 3.2 model to adapt it to specific tasks [2]. Or take DistilBERT — a distilled version of BERT [3]— or the DMD framework, which distills Stable Diffusion to speed up image generation by a factor of 30 [4].

At its core, knowledge distillation transfers knowledge from a large, complex model (the teacher) to a smaller, more efficient model (the student). The process involves creating a transfer set that includes both the original training data and additional data (either original or synthesized) pseudo-labeled by the teacher model. The pseudo-labels are known as soft labels — derived from the probabilities predicted by the teacher across multiple classes. These soft labels provide richer information than hard labels (simple class indicators) because they reflect the teacher’s confidence and capture subtle similarities between classes. For instance, they might show that a particular “1” is more similar to a “7” than to a “5.”

By training on this enriched transfer set, the student model can effectively mimic the teacher’s performance while being much lighter, faster, and easier to use.

The student model obtained in this way is more accurate than it would have been if it had been trained solely on the original training set.

Model compression [5] is often seen as a precursor to knowledge distillation, but there are important differences. Unlike knowledge distillation, model compression doesn’t seem to use soft labels, despite some claims in the literature [1,6]. I haven’t found any evidence that soft labels are part of the process. In fact, the method in the original paper doesn’t even rely on artificial neural networks (ANNs) as Model A. Instead, it uses an ensemble of models — such as SVMs, decision trees, random forests, and others.

Model compression works by approximating the feature distribution p(x) to create a transfer set. This set is then labelled by Model A, which provides the conditional distribution p(y∣x). The key innovation in the original work is a technique called MUNGE to approximate p(x). As with knowledge distillation, the goal is to train a smaller, more efficient Model B that retains the performance of the larger Model A.

As in knowledge distillation, the compressed model trained in this way can often outperform a similar model trained directly on the original data, thanks to the rich information embedded in the transfer set [5].

Often, “model compression” is used more broadly to refer to any technique that reduces the size of Model A [7,8]. This includes methods like knowledge distillation but also techniques that don’t rely on a transfer set, such as pruning, quantization, or low-rank approximation for neural networks.

When the problem isn’t computational complexity or memory, but the opacity of a model’s decision-making, pedagogical rule extraction offers a solution [9]. In this approach, a simpler, more interpretable model (Model B) is trained to replicate the behavior of the opaque teacher model (Model A), with the goal of deriving a set of human-readable rules. The process typically starts by feeding unlabelled examples — often randomly generated — into Model A, which labels them to create a transfer set. This transfer set is then used to train the transparent student model. For example, in a classification task, the student model might be a decision tree that outputs rules such as: “If feature X1 is above threshold T1 and feature X2 is below threshold T2, then classify as positive”.

The main goal of pedagogical rule extraction is to closely mimic the teacher model’s behavior, with fidelity — the accuracy of the student model relative to the teacher model — serving as the primary quality measure.

Interestingly, research has shown that transparent models created through this method can sometimes reach higher accuracy than similar models trained directly on the original data used to build Model A [10,11].

Pedagogical rule extraction belongs to a broader family of techniques known as “global” model explanation methods, which also include decompositional and eclectic rule extraction. See [12] for more details.

Model A doesn’t have to be an ML model — it could just as easily be a computer simulation of an economic or physical process, such as the simulation of airflow around an airplane wing. In this case, Data 1 consists of the differential or difference equations that define the process. For any given input, the simulation makes predictions by solving these equations numerically. However, when these simulations become computationally expensive, a faster alternative is needed: a surrogate model (Model B), which can accelerate tasks like optimization [13]. When the goal is to identify important regions in the input space, such as zones of system stability, an interpretable Model B is developed through a process known as scenario discovery [14]. To generate the transfer set (Data 2) for both surrogate modelling and scenario discovery, Model A is run on a diverse set of inputs.

In an insightful article on TDS [15], Niklas von Moers shows how semi-supervised learning can improve the performance of a convolutional neural network (CNN) on the same input data. This result fits into the first stage of the ML metamorphosis pipeline, where Model A is a trained CNN classifier. The transfer set, Data 2, then contains the originally labelled 1,000 training examples plus about 55,000 examples pseudo-labelled by Model A with high confidence predictions. I now train our target Model B, a decision tree classifier, on Data 2 and achieve an accuracy of 0.86 — much higher than 0.67 when training on the labelled part of Data 1 alone. This means that chaining the decision tree to the CNN solution reduces error rate of the decision tree from 0.33 to 0.14. Quite an improvement, wouldn’t you say?

For the full experimental code, check out the GitHub repository.

In summary, ML metamorphosis isn’t always necessary — especially if accuracy is your only concern and there’s no need for interpretability, faster inference, or reduced storage requirements. But in other cases, chaining models may yield significantly better results than training the target model directly on the original data.

For a classification task, the process involves:

So why don’t we always use ML metamorphosis? The challenge often lies in finding the right transfer set, Data 2 [9]. But that’s a topic for another story.

[1] Hinton, Geoffrey. “Distilling the Knowledge in a Neural Network.” arXiv preprint arXiv:1503.02531 (2015).

[3] Sanh, Victor, et al. “DistilBERT, a distilled version of BERT: Smaller, faster, cheaper and lighter. ” arXiv preprint arXiv:1910.01108 (2019).

[4] Yin, Tianwei, et al. “One-step diffusion with distribution matching distillation.” Proceedings of the IEEE/CVF Conference on Computer Vision and Pattern Recognition. 2024.

[5] Buciluǎ, Cristian, Rich Caruana, and Alexandru Niculescu-Mizil. “Model compression.” Proceedings of the 12th ACM SIGKDD international conference on Knowledge discovery and data mining. 2006.

[6] Knowledge distillation, Wikipedia

[7] An Overview of Model Compression Techniques for Deep Learning in Space, on Medium

[8] Distilling BERT Using an Unlabeled Question-Answering Dataset, on Towards Data Science

[9] Arzamasov, Vadim, Benjamin Jochum, and Klemens Böhm. “Pedagogical Rule Extraction to Learn Interpretable Models — an Empirical Study.” arXiv preprint arXiv:2112.13285 (2021).

[10] Domingos, Pedro. “Knowledge acquisition from examples via multiple models.” MACHINE LEARNING-INTERNATIONAL WORKSHOP THEN CONFERENCE-. MORGAN KAUFMANN PUBLISHERS, INC., 1997.

[11] De Fortuny, Enric Junque, and David Martens. “Active learning-based pedagogical rule extraction.” IEEE transactions on neural networks and learning systems 26.11 (2015): 2664–2677.

[12] Guidotti, Riccardo, et al. “A survey of methods for explaining black box models.” ACM computing surveys (CSUR) 51.5 (2018): 1–42.

[13] Surrogate model, Wikipedia

[14] Scenario discovery in Python, blog post on Water Programming

[15] Teaching Your Model to Learn from Itself, on Towards Data Science

ML Metamorphosis: Chaining ML Models for Optimized Results was originally published in Towards Data Science on Medium, where people are continuing the conversation by highlighting and responding to this story.

Originally appeared here:

ML Metamorphosis: Chaining ML Models for Optimized Results

Go Here to Read this Fast! ML Metamorphosis: Chaining ML Models for Optimized Results

On July 16, 1945, during the first nuclear bomb test conducted at Los Alamos, physicist Enrico Fermi dropped small pieces of paper and observed how far they moved when the blast wave reached him.

Based on this, he estimated the approximate magnitude of the yield of the bomb. No fancy equipment or rigorous measurements; just some directional data and logical reasoning.

About 40 seconds after the explosion the air blast reached me. I tried to estimate its strength by dropping from about six feet small pieces of paper before, during and after the passage of the blast wave. […] I estimated to correspond to the blast that would be produced by then thousand tons of T.N.T. — Enrico Fermi

This estimate turned out to be remarkably accurate considering how it was produced.

We’re forced to do quick-and-dirty approximations all the time. Sometimes we don’t have the data we need for a rigorous analysis, other times we simply have very little time to provide an answer.

Unfortunately, estimates didn’t come naturally to me. As a recovering perfectionist, I wanted to make my analyses as robust as possible. If I’m wrong and I took a quick-and-dirty approach, wouldn’t that make me look careless or incapable?

But over time, I realized that making a model more and more complex rarely leads to better decisions.

Why?

Napkin math, back-of-the-envelope calculations: Whatever you want to call it, it’s how management consultants and BizOps folks cut through complexity and get to robust recommendations quickly.

And all they need is structured thinking and a spreadsheet.

My goal with this article is to make this incredibly useful technique accessible to everyone.

In this article, I will cover:

Let’s get into it.

Most decisions businesses make don’t require a high-precision analysis.

We’re typically trying to figure out one of four things:

Often, we only need to know if something is going to be better / larger / more profitable than X.

For example, large corporations are only interested in working on things that can move the needle on their top or bottom line. Meta does over $100B in annual revenue, so any new initiative that doesn’t have the potential to grow to a multi-billion $ business eventually is not going to get much attention.

Once you start putting together a simple back-of-the-envelope calculation, you’ll quickly realize whether your projections land in the tens of millions, hundreds of millions, or billions.

If your initial estimate is way below the bar, there is no point in refining it; the exact answer doesn’t matter at that point.

Other examples:

Get an email whenever Torsten Walbaum publishes.

This scenario is the inverse of the one above.

For example, let’s say the CMO is considering attending a big industry conference last minute. He is asking whether the team will be able to pull together all the necessary pieces (e.g. a booth, supporting Marketing campaigns etc.) in time and within a budget of $X million .

To give the CMO an answer, it’s not that important by when exactly you’ll have all of this ready, or how much exactly this will cost. At the moment, he just needs to know whether it’s possible so that he can secure a slot for your company at the conference.

The key here is to use very conservative assumptions. If you can meet the timeline and budget even if things don’t go smoothly, you can confidently give green light (and then work on a more detailed, realistic plan).

Other examples:

Sometimes, you’re just trying to understand if thing A is better than thing B; you don’t necessarily need to know exactly how good thing A is.

For example, let’s say you’re trying to allocate Engineering resources across different initiatives. What matters more than the exact impact of each project is the relative ranking.

As a result, your focus should be on making sure that the assumptions you’re making are accurate on a relative level (e.g. is Eng effort for initiative A higher or lower than for initiative B) and the methodology is consistent to allow for a fair comparison.

Other examples:

Of course, there are cases where the actual number of your estimate matters.

For example, if you are asked to forecast the expected support ticket volume so that the Customer Support team can staff accordingly, your estimate will be used as a direct input to the staffing calculation.

In these cases, you need to understand 1) how sensitive the decision is to your analysis, and 2) whether it’s better if your estimate is too high or too low.

You know how accurate you need to be — great. But how do you actually create your estimate?

You can follow these steps to make your estimate as robust as possible while minimizing the amount of time you spend on it:

Let’s say you work at Netflix and want to figure out how much money you could make from adding games to the platform (if you monetized them through ads).

How do you structure your estimate?

The first step is to decompose the metric into a driver tree, and the second step is to segment.

At the top of your driver tree you have “Games revenue per day”. But how do you break out the driver tree further?

There are two key considerations:

1. Pick metrics you can find data for.

For example, the games industry uses standardized metrics to report on monetization, and if you deviate from them, you might have trouble finding benchmarks (more on benchmarks below).

2. Pick metrics that minimize confounding factors.

For example, you could break revenue into “# of users” and “Average revenue per user”. The problem is that this doesn’t consider how much time users spend in the game.

To address this issue, we could split revenue out into “Hours played” and “$ per hour played” instead; this ensures that any difference in engagement between your games and “traditional” games does not affect the results.

You can then break out each metric further, e.g.:

However, adding more detail is not always beneficial (more on that below).

In order to get a useful estimate, you need to consider the key dimensions that affect how much revenue you’ll be able to generate.

For example, Netflix is active in dozens of countries with vastly different monetization potential and to account for this, you can split the analysis by region.

Which dimensions are helpful in getting a more accurate estimate depends on the exact use case, but here are a few common ones to consider:

“Okay, great, but how do I know when segmentation makes sense?”

There are two conditions that need to be true for a segmentation to be useful:

You also need to make sure the segmentation is worth the effort. In practice, you’ll often find that only one or two metrics are materially different between segments.

Here’s what you can do in that case to get a quick-and-dirty answer:

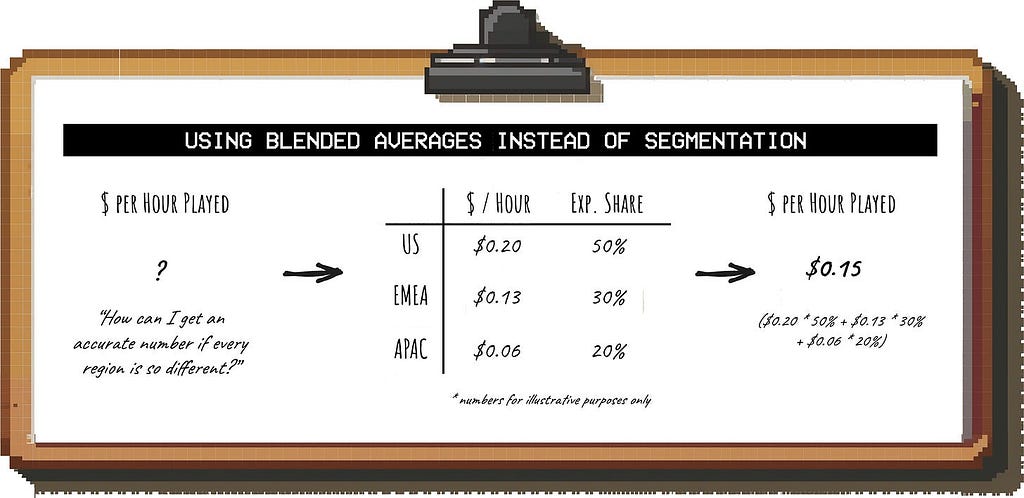

Instead of creating multiple separate estimates, you can calculate a blended average for the metric that has the biggest variance across segments.

So if you expect “$ per hour played” to vary substantially across regions, you 1) make an assumption for this metric for each region (e.g. by getting benchmarks, see below) and 2) estimate what the country mix will be:

You then use that number for your estimate, eliminating the need to segment.

If you have solid data to base your assumptions on, adding more detail to your analysis can improve the accuracy of your estimate; but only up to a point.

Besides increasing the effort required for the analysis, adding more detail can result in false precision.

So what falls into the “too much detail” bucket? For the sake of a quick and dirty estimation, this would include things like:

Adding this level of detail would increase the number of assumptions exponentially without necessarily making the estimate more accurate.

Now that you have the inputs to your estimate laid out, it’s time to start putting numbers against them.

If you ran an experiment (e.g. you rolled out a prototype for “Netflix games” to some users) and you have results you can use for your estimate, great. But a lot of the time, that’s not the case.

In this case, you have to get creative. For example, let’s say that to estimate our DAU for games, we want to understand how many Netflix users might see and click on the games module in their feed.

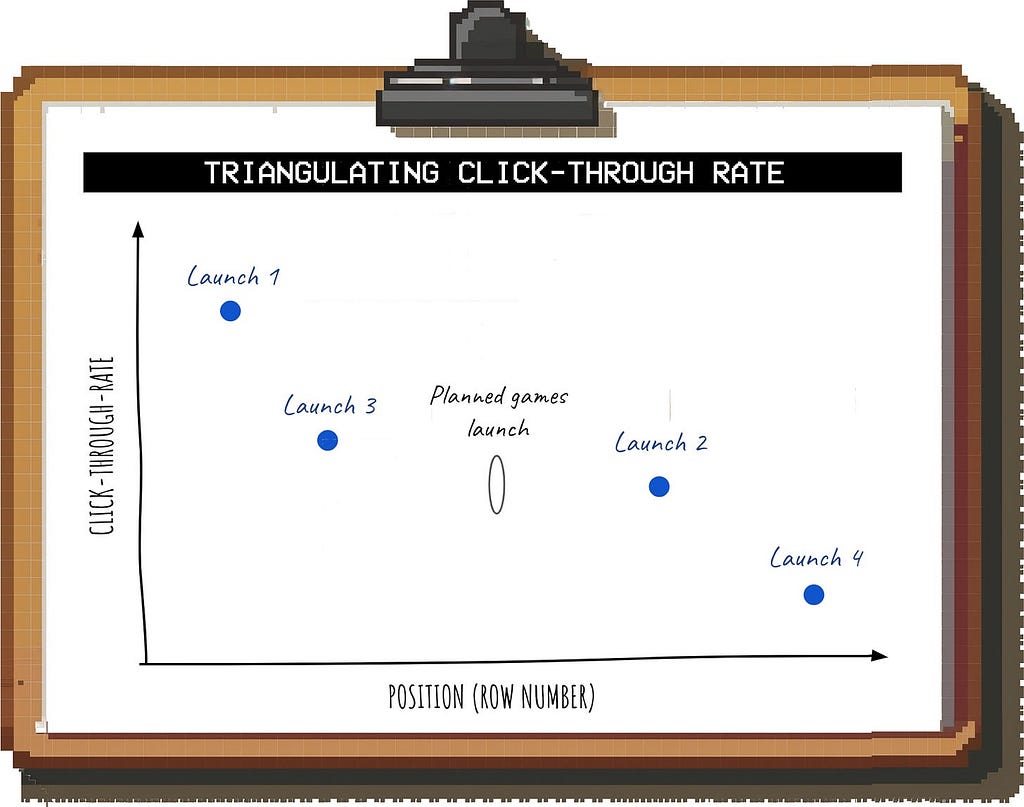

To do this, you can compare it against other launches with similar entry points:

Based on the last few launches, you can then triangulate the expected click-through-rate for games:

These kind of relationships are often close enough to linear (within a reasonable range) so that this type of approximation yields useful results.

Once you get some actual data from an experiment or the launch, you can refine your assumptions.

External benchmarks (e.g. industry reports, data vendors) can be helpful to get the right ballpark for a number if internal data is unavailable.

There are a few key considerations:

After looking at internal and external data from different sources, you will likely have a range of numbers to choose from for each metric.

Take a look at how wide the range is; this will show you which inputs move the needle on the answer the most.

For example, you might find that the CPM benchmarks from different reports are very similar, but there is a very wide range for how much time users might spend playing your games on a daily basis.

In this case, your focus should be on fine-tuning the “hours played” assumption:

For example, you could compare the play time you’re projecting for games against the total time users currently spend on Netflix.

Even if some of the time is incremental, it’s unrealistic that more than, say, 5% — 10% of the total time is spent on games (most of the users came to Netflix for video content, and there are better gaming offerings out there, after all).

If you’re doing a quick-and-dirty estimate, people don’t expect it to be perfectly accurate.

However, they still want to understand what it would take for the numbers to be so different that they would lead to a different decision or recommendation.

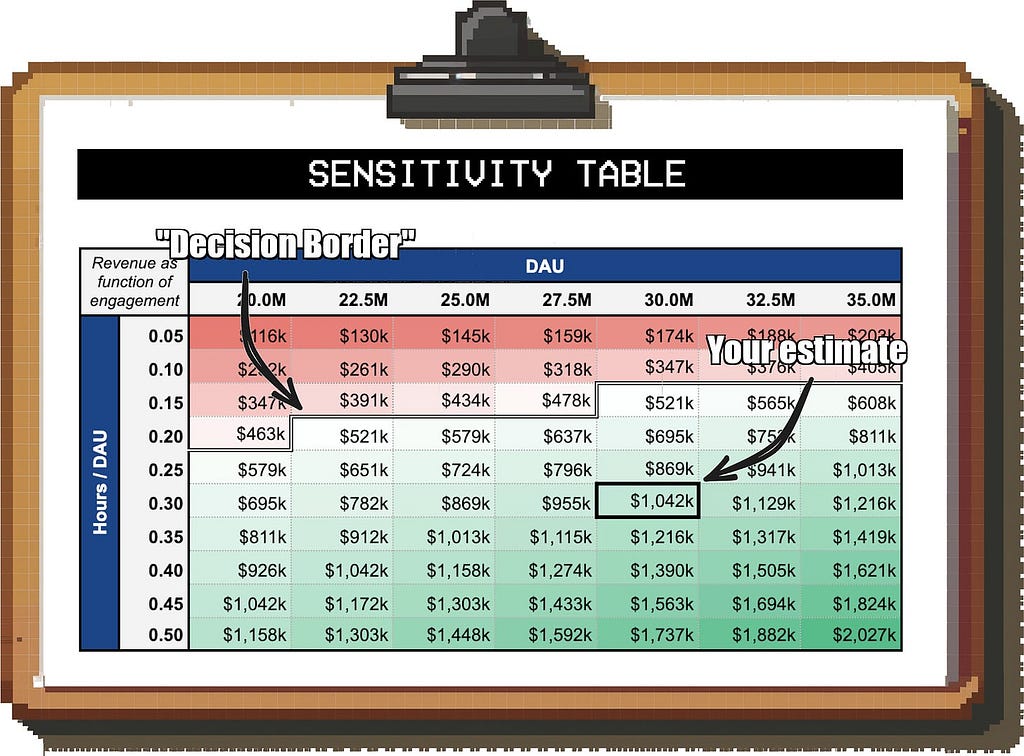

A good way to visualize this is a sensitivity table.

Let’s say the business wants to reach at least $500k in ad revenue per day to even think about launching games. How likely are you to reach this?

On the X and Y axis of the table, you put the two input metrics that you feel least sure about (e.g. “Daily Active Users (DAU)” and “Time Spent per DAU”); the values in the table represent the number you’re estimating (in this case, “Games revenue per day”).

You can then compare your best estimate against the minimum requirement of the business; for example, if you’re estimating 30M DAU and 0.3 hours of play time per DAU, you have a comfortable buffer to be wrong on either assumption.

While it’s called napkin math, three lines scribbled on a cocktail napkin are rarely enough for a solid estimate.

However, you also don’t need a full-blown 20-tab model to get a directional answer; and often, that directional answer is all you need to move forward.

Once you get comfortable with rough estimates, they allow you move faster than others who are still stuck in analysis paralysis. And with the time you save, you can tackle another project — or go home and do something else.

For more hands-on analytics advice, consider following me here on Medium, on LinkedIn or on Substack.

Mastering Back-of-the-Envelope Math Will Make You a Better Data Scientist was originally published in Towards Data Science on Medium, where people are continuing the conversation by highlighting and responding to this story.

Originally appeared here:

Mastering Back-of-the-Envelope Math Will Make You a Better Data Scientist

Go Here to Read this Fast! Mastering Back-of-the-Envelope Math Will Make You a Better Data Scientist