Go Here to Read this Fast! 3 great Amazon Prime Video movies you need to watch on Valentine’s Day

Originally appeared here:

3 great Amazon Prime Video movies you need to watch on Valentine’s Day

Go Here to Read this Fast! 3 great Amazon Prime Video movies you need to watch on Valentine’s Day

Originally appeared here:

3 great Amazon Prime Video movies you need to watch on Valentine’s Day

Sony may shrink the gap between the launches of its PlayStation exclusives and PC ports. Company president Hiroki Totoki suggested in a post-earnings call Q&A session Wednesday (via VGC) that he wants PlayStation to go “aggressive on improving our margin performance,” with “multi-platform” games playing a significant role. He clarified in the talk that, by multi-platform, he meant on PlayStation and PC — not Xbox or Switch.

When asked about Sony’s profits not keeping up with increasing gross income, he said hardware and first-party games were two areas of focus. He noted that hardware cost reduction this console cycle was “difficult to come by,” suggesting we won’t see any permanent console price drops.

“I personally think there are opportunities out there for improvement of margin, so I would like to go aggressive on improving our margin performance,” he continued. Totoki hinted one way to get there is to cash in more on its (often critically acclaimed and commercially successful) PlayStation Studios titles, like Marvel’s Spider-Man 2 and God of War: Ragnarok.

“In the past, we wanted to popularize consoles, and a first-party title’s main purpose was to make the console popular,” Totoki said in the Q&A. “This is true, but there’s a synergy to it, so if you have strong first-party content — not only on our console but also other platforms, like computers — a first-party [game] can be grown with multi-platform, and that can help operating profit to improve, so that’s another one we want to proactively work on.”

That’s a clear shift from PlayStation Studios head Herman Hulst’s thoughts in 2022. He said then that PC gamers would have to wait “at least a year” before seeing first-party PlayStation games (minus live service titles) on their computers. God of War (2018) and the first Marvel’s Spider-Man had about a four-year gap between their PS4 and PC launches. The latter’s Miles Morales spin-off saw about a two-year turnaround.

On February 8, Sony launched Helldivers 2 on PS5 and Windows simultaneously. VGC notes the game led to PlayStation Studios’ highest concurrent Steam player count — beating God of War (2018), The Last of Us Part I and Horizon Zero Dawn. Helldivers 2 was developed by Arrowhead Games with Sony Interactive Entertainment publishing.

It isn’t clear if Totoki meant we can expect future PlayStation tentpoles like the upcoming Wolverine game or the ever-popular Spider-Man, God of War or various Naughty Dog franchises to appear on PC on the same day as console. But a strategy shift is underway regardless, and Totoki will have the leverage to put the plan into action: He takes over for Jim Ryan as interim CEO of Sony Interactive Entertainment in April.

This article originally appeared on Engadget at https://www.engadget.com/sony-wants-its-playstation-exclusives-to-come-to-pc-earlier-212001939.html?src=rss

Go Here to Read this Fast! Sony wants its PlayStation exclusives to come to PC earlier

Originally appeared here:

Sony wants its PlayStation exclusives to come to PC earlier

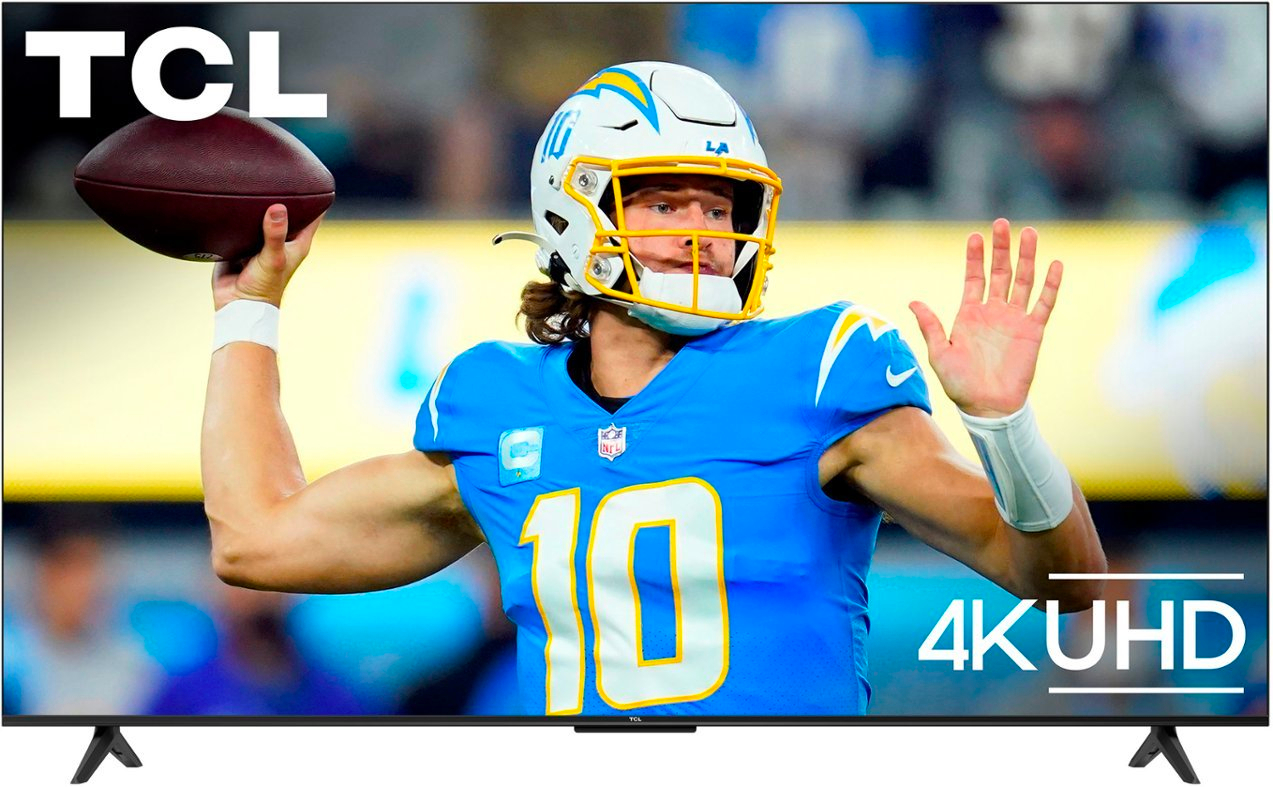

Baseball fans who’ve had to stay glued to their computer to watch several MLB games simultaneously will soon be able to kick back in front of their TV and do the same thing. The league has announced several updates for MLB.TV for this upcoming season. For one thing, the MLB apps on supported Apple TV, Fire TV and Google TV devices will let you watch up to four games simultaneously in Multiview.

Until now, Apple TV users, for instance, were restricted to watching a maximum of two games at once through picture-in-picture. The upgrade should become especially useful later in the season as the race for playoff spots comes down to the wire and fans can watch multiple teams play for a post-season slot simultaneously with more ease. You’ll also be able to stream more than 7,000 Minor League Baseball games, featuring affiliates from all 30 MLB teams.

In addition, MLB.TV is bringing Catchup Mode to certain streaming platforms this season, but did not specify which. This mode will feature in-game highlights for key moments and plays you might have missed, so if you missed the first few innings of a game that’s in progress, you can quickly get up to speed.

Fans can expect new episodes of original shows such as Carded and Inside Stitch, along with more documentaries and live programming. Select teams will provide local pregame and postgame coverage, while MLB Big Inning will deliver the top action from around the league with highlights and live look-ins. Those who authenticate subscriptions through TV providers will be able to stream every post-season game, as well as the 2024 All-Star Game.

The MLB All Teams Yearly subscription is the same price as last year at $150. It includes access to every out-of-market regular season game and some Spring Training games with no blackout restrictions, both live and on-demand. A monthly subscription is also available for $30.

This article originally appeared on Engadget at https://www.engadget.com/mlbtvs-four-game-multiview-feature-is-coming-to-apple-amazon-and-google-tv-devices-210523812.html?src=rss

X has allowed dozens of sanctioned individuals and groups to pay for its premium service, according to a new report from the Tech Transparency Project (TTP). The report raises questions about whether X is running afoul of US sanctions.

The report found 28 verified accounts belonging to people and groups the US government considers to be a national security threat. The group includes two leaders of Hezbollah, accounts associated with Houthis in Yemen and state-run media accounts from Iran and Russia. Of those, 18 of the accounts were verified after X began charging for verification last spring.

“The fact that X requires users to pay a monthly or annual fee for premium service suggests that X is engaging in financial transactions with these accounts, a potential violation of U.S. sanctions,” the report says. As the TTP points out, X’s own policies state that sanctioned individuals are prohibited from paying for premium services. Some of the accounts identified by the TTP also had ads in their replies, according to the group, “raising the possibility that they could be profiting from X’s revenue-sharing program.”

Changing up Twitter’s verification policy was one of the most significant changes implemented by Elon Musk after he took over the company. Under the new rules, anyone can pay for a blue checkmark if they subscribe to X Premium. X doesn’t require users to submit identification, and the company has at times scrambled to shut down impersonators.

X also offers gold checkmarks to advertisers as part of its “verified organizations” tier, which starts at $200 a month. The TTP report found that accounts belonging to Iran’s Press TV and Russia’s Tinkoff Bank — both sanctioned entities — had gold checks. X has also given away gold checks to at least 10,000 companies. As the report points out, even giving away the gold badge to sanctioned groups could violate US government policies.

X didn’t immediately respond to a request for comment, but it appears that the company has removed verification from some of the accounts named in the TTP’s report. “X, formerly known as Twitter, has removed the blue check and suspended the paid subscriptions of several Iranian outlets,” Press TV tweeted from its account, which still has a gold check. The Hezbollah leaders’ accounts are also no longer verified.

This article originally appeared on Engadget at https://www.engadget.com/x-let-terrorist-groups-pay-for-verification-report-says-201254824.html?src=rss

Go Here to Read this Fast! X let terrorist groups pay for verification, report says

Originally appeared here:

X let terrorist groups pay for verification, report says

In an absolutely bananas turn of events, a typo in an earnings report caused Lyft shares to skyrocket nearly 70 percent after Tuesday’s closing stock market bell, as reported by CBS. There was an extra zero in the report that suggested a five percent margin expansion in 2024, instead of a .5 percent margin. This sent investors into a tizzy, as the company has long struggled to turn a profit.

The mistake was even present in Lyft’s slide deck, which was part of that earnings report, and an accompanying press release. The company quickly corrected the mistake, calling it a clerical error, but the stock surge had already begun. Lyft CFO Erin Brewer addressed the issue in an earnings call yesterday evening which caused the stocks to reverse course. It’s worth noting that the earnings report was still good news for Lyft, even without that mistake, so the stock price experienced a more stable increase of around 35 percent.

Now, onto the blame game. Lyft CEO David Risher appeared on CNBC’s Squawk Box to take responsibility for the mistake, saying “look, it was a bad error, and that’s on me.” Risher went on to note that it was “super frustrating” for everyone on the team and said that he could see a fellow employee’s “jaw drop” when discovering the issue.

The good news? Even with that adjustment, this is Lyft’s best day since the company’s initial IPO offering back in 2019. Yesterday’s earnings report indicated $1.22 billion in revenue for the quarter, an increase of four percent from last year. Bookings increased 17 percent for the quarter, accounting for $3.7 billion. Risher called it a “great quarter.”

A misplaced zero on a spreadsheet isn’t the ridesharing giant’s only concern. Thousands of Lyft and Uber drivers are going on strike today to demand better pay and safer working conditions. The striking workers are primarily clustered around ten major US airports, though it’s only planned to last for a few hours.

This article originally appeared on Engadget at https://www.engadget.com/an-earnings-typo-sent-lyfts-stock-price-into-the-stratosphere-193904095.html?src=rss

Originally appeared here:

Xiaomi Watch 2 is shaping up to be a true Pixel Watch 2 rival at half the price

Originally appeared here:

A tiny live-boot Linux installation is back from the dead — sleeping giant awakens for a new lease of life

Genesis Global has secured approval from a bankruptcy court to sell approximately 35 million shares of the Grayscale Bitcoin Trust (GBTC), valued at over $1.3 billion, Bloomberg News reported Feb. 14. The decision, delivered by Judge Sean Lane, allows Genesis to liquidate its GBTC shares into Bitcoin or cash. The sale is poised to inject […]

The post Genesis secures court approval to sell GBTC shares worth $1.3 billion appeared first on CryptoSlate.

Go here to Read this Fast! Genesis secures court approval to sell GBTC shares worth $1.3 billion

Originally appeared here:

Genesis secures court approval to sell GBTC shares worth $1.3 billion